Sales tax reporting software is revolutionizing how businesses manage their tax obligations. It automates complex calculations, ensuring accuracy and compliance. This sophisticated tool simplifies the often daunting task of tracking sales tax liabilities across various jurisdictions, saving businesses valuable time and resources.

From small startups to large corporations, the software offers customizable features that adapt to specific business needs. This allows businesses to focus on core operations while the software handles the intricate details of sales tax reporting, reducing the risk of errors and penalties.

Sales tax reporting can be a complex and time-consuming process, especially for businesses operating across multiple jurisdictions. Properly managing sales tax obligations is crucial for avoiding penalties and maintaining a healthy financial position. This comprehensive guide explores sales tax reporting software, its benefits, features, and how to choose the right solution for your business.

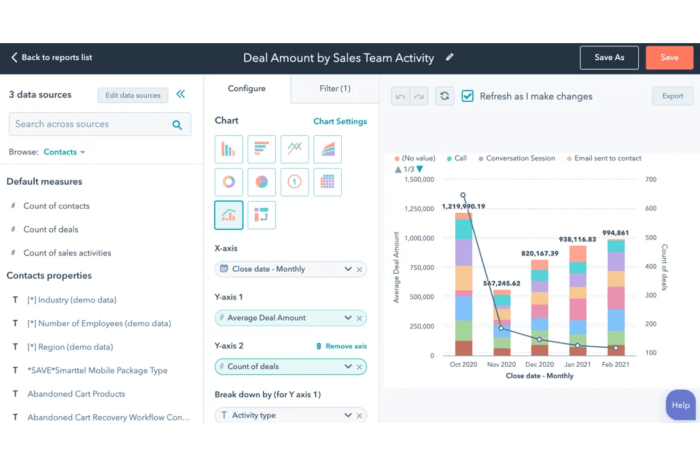

Source: revopsteam.com

Understanding the Importance of Sales Tax Reporting

Sales tax compliance is a legal requirement in most regions. Failure to accurately report and remit sales taxes can result in substantial penalties and interest charges. Furthermore, incorrect reporting can damage your business reputation and create legal issues. Sales tax reporting software automates this crucial process, ensuring accuracy and efficiency.

Key Benefits of Using Sales Tax Reporting Software

- Accuracy and Efficiency: Automated calculations and data entry reduce the risk of errors and save valuable time.

- Compliance Management: Software can help you stay up-to-date with changing tax regulations and ensure you’re compliant across all relevant jurisdictions.

- Reduced Administrative Burden: Automating tasks like reporting, filing, and reconciliation frees up your staff to focus on other core business functions.

- Improved Financial Transparency: Real-time tracking and reporting provide insights into sales tax liabilities and overall financial health.

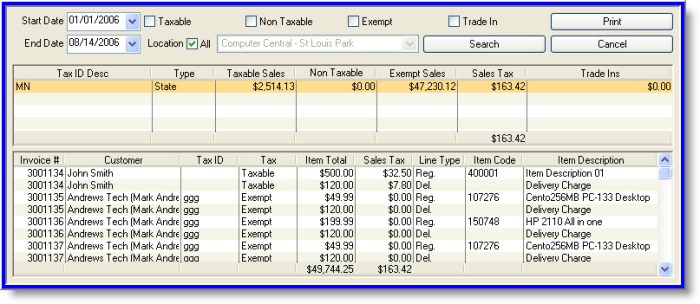

- Streamlined Reporting: Generating reports for various tax jurisdictions and regulatory bodies becomes simplified and more organized.

Features to Look for in Sales Tax Reporting Software

When selecting sales tax reporting software, consider these crucial features:

Jurisdiction Coverage and Tax Rates

The software should support the sales tax jurisdictions where your business operates. Accurate tax rate management and updates are essential for compliance.

Inventory Management Integration

Integration with your existing inventory management system is highly beneficial for accurate sales tax calculation based on product-specific tax rates.

Sales Data Import Capabilities

Seamless import of sales data from various sources like POS systems, e-commerce platforms, or accounting software is a must-have for efficient reporting.

Reporting and Analysis Tools

Comprehensive reporting features, including customizable dashboards and detailed financial summaries, help analyze sales tax performance and identify trends.

Tax Rate Updates and Compliance Tracking

Automatic updates for tax rates and regulations ensure compliance with ever-changing tax laws across multiple jurisdictions. The software should track compliance progress and deadlines.

Choosing the Right Sales Tax Reporting Software

Several factors influence the best choice of software for your business. Consider:

Business Size and Complexity

Small businesses may benefit from simpler, more affordable options, while larger businesses might require more robust and customizable solutions.

Scalability Needs, Sales tax reporting software

As your business grows, the chosen software should be scalable to accommodate increasing sales volumes and tax jurisdictions.

Integration with Existing Systems

Ensure compatibility with your current accounting software, inventory management systems, and other business applications.

Source: iisonline.com

Customer Support and Training Resources

Reliable customer support and user-friendly training materials are essential for successful implementation and ongoing use.

FAQ: Sales Tax Reporting Software

Q: What are some popular sales tax reporting software options?

- TaxJar

- AvaTax

- Salesforce

- QuickBooks

Q: How much does sales tax reporting software typically cost?

Pricing varies significantly depending on features, support, and usage. It’s best to contact vendors directly for specific pricing information.

Q: How can I determine if sales tax reporting software is right for my business?

Assess your current sales tax processes, identify pain points, and evaluate the features and pricing of available software solutions.

Conclusion

Sales tax reporting software is a valuable tool for businesses to streamline their compliance procedures, minimize errors, and reduce administrative burdens. By selecting the right software and understanding its key features, you can ensure accuracy, efficiency, and compliance with evolving sales tax regulations.

Call to Action: Explore the various sales tax reporting software options available to find the best solution for your business needs. Contact providers for demos and personalized consultations.

Sources:

In conclusion, sales tax reporting software provides a robust and efficient solution for businesses of all sizes. By automating the process, businesses gain valuable insights into their sales tax data, enabling better financial planning and improved compliance. The future of sales tax management is undoubtedly automated, and this software is key to success.

FAQ Overview

What are the common sales tax reporting software integrations?

Many sales tax reporting software solutions integrate with accounting software like QuickBooks or Xero, and e-commerce platforms like Shopify and WooCommerce. This seamless integration streamlines data flow and reduces manual entry errors.

How does sales tax reporting software handle different jurisdictions?

The software accounts for varying sales tax rates and regulations across different states, counties, and cities. It automatically calculates the correct tax amount based on the transaction’s location.

Source: geekflare.com

Is sales tax reporting software suitable for businesses with a complex sales process?

Yes, many solutions cater to complex sales scenarios, including multi-state sales and various product types. They handle the complexities of different tax rules with ease.