Get auto insurance online today and experience a streamlined process. This method offers convenient ways to compare quotes, find the right coverage, and complete your application quickly. Avoid the hassle of traditional insurance methods and embrace the ease of online shopping for auto insurance.

Understanding your needs and comparing various online insurance platforms is key to making the best decision. This guide will walk you through the process, highlighting the benefits and potential challenges. From comparing quotes to finalizing your purchase, we’ll cover every step to ensure a smooth and straightforward experience.

Understanding the Search Intent

Source: amistadinsuranceservices.com

Users searching “get auto insurance online today” likely need a quick and convenient way to secure auto insurance. This search reflects a desire for immediate solutions and a departure from traditional, potentially time-consuming, in-person insurance processes.This search encompasses a range of motivations, from simply comparing quotes to the actual purchase of a policy. Users may be seeking the most affordable option, exploring new insurance providers, or perhaps switching policies.

Ultimately, the common thread is a need for a streamlined and efficient online experience.

User Needs and Motivations

Users searching for “get auto insurance online today” often have a variety of motivations. They might be comparing quotes from different insurers, actively seeking to purchase insurance for a new vehicle or an existing one, or simply exploring different options before making a decision. A potential buyer might be looking to understand the benefits of online insurance.

Pain Points of Traditional Auto Insurance

Traditional auto insurance processes can be frustrating for many. Long wait times, complicated paperwork, and a lack of transparency in pricing often discourage consumers. The traditional approach can be cumbersome, requiring numerous phone calls, visits to offices, and a significant investment of time.

Benefits of Online Auto Insurance

Online auto insurance offers several advantages. It provides instant quotes, allowing users to compare multiple options quickly and efficiently. This streamlined process saves significant time and effort, enabling consumers to make informed decisions rapidly. Further, it often includes transparent pricing and easy-to-understand coverage details.

Different Search Contexts

The phrase “get auto insurance online today” can be used in various contexts. A recent car buyer might use it to immediately secure insurance. Someone looking to switch providers could use this search term to compare different offers. Even someone with existing insurance might use this phrase to explore options for better coverage.

User Journey Stages

| Stage | User Action | Potential Needs |

|---|---|---|

| Awareness | Researching options | Comparison of plans, cost breakdowns |

| Consideration | Comparing quotes | Features, coverage details, customer reviews |

| Decision | Submitting application | Insurance documents, payment options |

This table Artikels a potential user journey from initial awareness to final purchase. Each stage highlights the likely needs and actions of the user as they progress through the process.

Comparison of Online Insurance Platforms

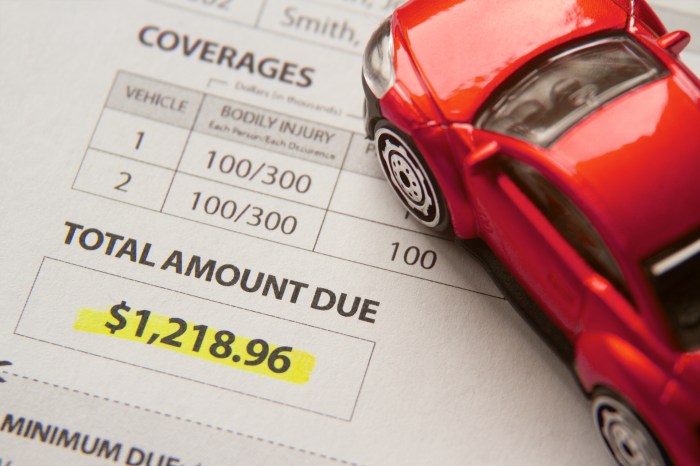

Source: quoteinspector.com

Navigating the online landscape for auto insurance can feel overwhelming. Numerous platforms compete for your business, each promising speed, affordability, and comprehensive coverage. Understanding the nuances of these platforms is key to securing the best deal tailored to your needs.Online auto insurance platforms offer a convenient alternative to traditional brick-and-mortar agencies. They leverage technology to streamline the process, from initial quotes to policy management.

This often translates to faster turnaround times and potentially lower premiums.

Different Online Insurance Providers

Various online insurance providers cater to diverse needs and preferences. Some specialize in specific types of coverage, such as young drivers or drivers with a history of accidents. Others focus on providing comprehensive packages, encompassing various add-ons like roadside assistance or rental car reimbursement.

Features and Services Offered

Different platforms offer varying features and services. Some may excel in providing quick quotes, while others might prioritize customer support or personalized recommendations. A platform’s user interface and mobile app capabilities are also crucial factors in determining its ease of use and accessibility. Some platforms provide detailed policy explanations and interactive tools for understanding your coverage, while others might have more limited resources.

This difference in service offerings should be considered when evaluating a platform.

Pricing Models

Pricing models vary significantly among online auto insurance providers. Factors like your driving record, vehicle type, location, and coverage choices all influence the premium. Some platforms utilize sophisticated algorithms to assess risk and adjust pricing accordingly, while others might rely on more traditional methods. For example, some providers offer discounts for safe driving habits, while others might emphasize bundled discounts.

It is crucial to scrutinize the pricing structure of each platform and compare them side-by-side.

Comparative Analysis

| Platform | Strengths | Weaknesses |

|---|---|---|

| Platform A | Fast quote process; user-friendly interface; wide selection of add-ons | Limited coverage options; potentially higher premiums for specific drivers; limited customer support hours |

| Platform B | Excellent customer support; personalized policy recommendations; competitive pricing for safe drivers | Slightly slower quote process; may have a higher initial premium for those with a less-than-perfect driving record; less flexible coverage options |

| Platform C | Focus on bundling discounts; competitive rates for comprehensive packages; easy online claim filing | Limited customer support; fewer options for specialized add-ons; might have more complex policies |

Comparing Insurance Policies Effectively

To compare insurance policies effectively, scrutinize the details of each policy. Pay close attention to the coverage limits, deductibles, and exclusions. Compare the premiums for similar coverage packages from different providers. Don’t just look at the quoted price; delve into the specific terms and conditions. For instance, if you anticipate needing roadside assistance frequently, ensure that the policy includes this feature.

Read the fine print carefully and understand the specific terms of each policy. This detailed review is vital for making an informed decision.

Steps to Get Auto Insurance Online Today

Source: lopriore.com

Getting auto insurance online is a convenient and efficient way to compare rates and find the best coverage for your needs. This process typically involves several key steps, from obtaining a quote to completing the application and finalizing payment. Understanding these steps will help you navigate the online process smoothly.The online auto insurance application process is designed to be user-friendly, often employing intuitive interfaces.

This approach streamlines the traditionally paper-heavy process, saving time and effort for both consumers and insurance providers. Each step typically requires specific information and documentation, which are clearly Artikeld.

Obtaining a Quote Online

To begin, you’ll need to access an online insurance platform. These platforms often have dedicated quote generators that gather necessary details to provide you with a personalized insurance estimate. Providing accurate information is crucial for receiving an accurate quote.

Necessary Information for a Quote

The information required to get a quote varies depending on the insurance provider, but common elements include:

- Your name, address, and contact information.

- Your driving history, including any accidents or traffic violations.

- Vehicle details, such as make, model, year, and VIN (Vehicle Identification Number).

- Desired coverage amounts and types (liability, collision, comprehensive).

- Payment information (credit card or other methods).

- Details about any other drivers who will be using the vehicle.

Providing complete and accurate information helps the insurance provider assess your risk profile and provide an appropriate quote.

Completing the Application Process

Once you have received a quote, you can proceed to complete the online application. This involves providing further details and confirming the coverage options you desire.

- Review the details of the policy to ensure they align with your requirements.

- Complete all necessary sections of the application form.

- Verify your personal information and vehicle details.

- Choose a payment method.

The application process often requires confirmation of your identity and payment information to ensure security.

Available Payment Methods

Several payment options are commonly available online. These may include:

- Credit cards (Visa, MasterCard, American Express, etc.)

- Debit cards

- Electronic bank transfers

- Other digital payment platforms

Selecting a payment method that aligns with your preferences and financial capabilities is essential.

Required Documentation, Get auto insurance online today

Some insurance providers might require specific documents to complete the application process. This might include:

- Proof of identity (driver’s license or state-issued ID)

- Proof of vehicle ownership (vehicle registration)

- Proof of address (utility bill, bank statement, etc.)

- Previous insurance information (if applicable)

These documents verify your identity and provide the necessary details for insurance assessment.

Step-by-Step Guide to Getting Auto Insurance Online

- Access an online insurance platform: Find a reputable insurance provider and access their online platform.

- Obtain a quote: Use the platform’s quote generator to provide your details and receive an estimate.

- Review the quote: Carefully examine the coverage options and associated costs.

- Complete the application: Provide the requested information, confirming your choices and details.

- Choose a payment method: Select a payment method that suits your needs.

- Upload necessary documents: Provide any required documentation.

- Review and finalize: Review the policy terms and conditions, ensuring they meet your expectations. Submit the application and finalize the purchase.

Following these steps ensures a smooth and efficient online auto insurance experience.

Illustrating the User Experience

Getting auto insurance online should be a seamless and intuitive process. A positive user experience is crucial for fostering trust and encouraging repeat business. This section details the ideal user journey, highlighting potential challenges and solutions.A streamlined process, clear communication, and readily available support contribute significantly to a positive user experience. This leads to increased customer satisfaction and ultimately, higher conversion rates.

Ideal User Journey

The ideal user journey for purchasing auto insurance online begins with a clear understanding of the user’s needs and goals. The user should be able to easily navigate the website, find the information they require, and complete the purchase without significant friction.An example of a user journey is as follows:

- A user searches for auto insurance online, specifying their vehicle details, driving history, and desired coverage levels. They may utilize filtering options to refine their search results.

- The user compares quotes from multiple insurance providers, considering factors such as premium costs, coverage options, and customer reviews.

- The user selects the best option that aligns with their needs and budget, reviewing policy details carefully to ensure clarity on coverage and exclusions.

- The user provides necessary personal information and payment details, verifying accuracy throughout the process.

- Finally, the user receives confirmation of their policy purchase and access to important documents, like the insurance certificate and policy summary.

User Flow Diagram

The user flow diagram below illustrates the sequential steps involved in the process:

Note: The above is a placeholder for a user flow diagram. A visual diagram would clearly illustrate the steps involved, from initial search to policy purchase.

Potential Challenges and Solutions

The online auto insurance purchase process, while convenient, may present challenges for some users. Understanding these potential hurdles and offering effective solutions is key to a positive user experience.

| Challenge | Possible Solution |

|---|---|

| Difficulty understanding policy terms | Clear and concise explanations, using plain language and providing examples. Interactive tools that allow users to explore different coverages and scenarios are helpful. |

| Slow loading pages | Optimized website design, utilizing efficient code and ensuring appropriate server resources. This reduces loading times and improves overall performance. |

| Security concerns | Clear and visible security measures, such as secure socket layers (SSL) and robust encryption protocols, to build user trust. Displaying security badges and seals can further reassure users. |

| Inaccurate data entry | Validation checks at each step to ensure accurate input, providing clear error messages and guidance, and allowing for easy correction of any mistakes. |

Content for the Website

Getting auto insurance online is a convenient and often cost-effective way to protect your vehicle. This page provides a comprehensive overview of the process, highlighting key benefits, addressing common questions, and guiding you toward securing the right coverage.This page will equip users with the knowledge and tools necessary to navigate the online insurance market confidently. It aims to be a valuable resource, showcasing the ease and advantages of securing auto insurance online.

Website Page Topics

This section Artikels the key topics that should be covered on a dedicated website page for getting auto insurance online. These topics provide a comprehensive resource for users seeking to understand the process and choose the best option.

- Understanding Your Needs: This section will help users determine the appropriate coverage for their individual needs, considering factors such as driving history, vehicle type, and desired protection levels.

- Comparing Online Platforms: This section will compare and contrast various online insurance platforms, offering insights into their features, pricing models, and customer reviews.

- Step-by-Step Guide: This section will provide a clear, concise guide to navigating the online insurance application process, from quote requests to finalizing the policy.

- Policy Information: This section will detail the essential components of an auto insurance policy, explaining different types of coverage and associated costs.

- Protecting Your Information: This section will reassure users about the security measures in place to protect their personal and financial information during the online process.

Key Benefits of Online Auto Insurance

This section Artikels the advantages of obtaining auto insurance online. These benefits underscore the convenience and value proposition of this method.

- Convenience and Accessibility: Online platforms offer 24/7 access to insurance quotes and applications, eliminating the need for physical visits to an office.

- Faster Quotes and Approvals: Online platforms often process quotes and approvals significantly faster than traditional methods, allowing for quicker access to coverage.

- Competitive Pricing: Online platforms provide access to multiple insurance providers, allowing users to compare rates and secure the most competitive quotes.

- Transparent Information: Online platforms provide clear and concise information about coverage options and associated costs, fostering transparency in the process.

- Easy Policy Management: Many online platforms offer tools for managing your policy online, including updating information, making payments, and accessing your policy documents.

FAQ Section Design

This section Artikels the design of a frequently asked questions (FAQ) section related to online auto insurance. This section addresses common concerns and clarifies the process.

- Organized Format: Use a clear and concise format, ensuring that questions are easily identifiable and answers are readily accessible.

- Comprehensive Coverage: Include a broad range of frequently asked questions to cover various aspects of the online auto insurance process.

- Clear and Concise Language: Use plain language to ensure that answers are easy to understand for all users, avoiding technical jargon.

- Visual Aids (Optional): Use visual aids such as diagrams or charts to enhance understanding, where appropriate.

Common Questions and Answers

This table presents a selection of frequently asked questions and their corresponding answers related to online auto insurance.

| Question | Answer |

|---|---|

| How secure is my information? | Our platform utilizes industry-standard encryption protocols to protect your personal and financial data. |

| What if I have a history of accidents? | We can still provide you with a quote. Our system will assess your situation and provide an appropriate insurance option, based on your circumstances. |

| What if I have questions after getting a quote? | Our customer support team is available to answer any questions you may have. Contact us through phone or email for assistance. |

| What if I don’t have a perfect driving record? | We can still offer a quote. Our platform will take into account your driving history when providing a personalized insurance option. |

Effective Calls-to-Action

This section provides examples of effective calls-to-action (CTAs) to encourage users to obtain auto insurance online. These CTAs are designed to motivate users to take the next step.

- “Get a Free Quote Today”: This clear and concise CTA encourages immediate action.

- “Secure Your Coverage Now”: This CTA emphasizes the importance of protection and encourages urgency.

- “Compare Rates and Save”: This CTA highlights the opportunity to save money while obtaining insurance.

- “Start Your Online Application”: This CTA guides users directly to the application process.

Ending Remarks: Get Auto Insurance Online Today

Source: slidesharecdn.com

Getting auto insurance online today is easier than ever. This guide provided a comprehensive overview, helping you navigate the process from start to finish. By comparing various platforms, understanding the steps involved, and addressing potential challenges, you’ll be well-equipped to secure the right coverage for your needs. Remember to carefully consider your options and choose the platform that best fits your requirements.

FAQ Compilation

How secure is my information when getting auto insurance online?

Our platform utilizes industry-standard encryption to protect your personal and financial data.

What if I have a history of accidents or violations?

Many online providers can still offer a quote, even with a history of accidents or violations. Be prepared to provide details about your driving record and any related information during the quote process.

What types of payment methods are available?

Most online insurance platforms accept various payment methods, such as credit cards, debit cards, and bank transfers. Check with the specific provider for their accepted payment options.

How long does the process typically take?

The time it takes to get auto insurance online can vary depending on the complexity of your application and the specific platform you use. However, most platforms aim for a relatively quick process, often providing quotes and completing applications within a few hours.