Compare car insurance rates Texas is a crucial step for any driver in the Lone Star State. Finding the best deal can save you significant money each year. This guide delves into the various factors influencing Texas car insurance premiums, explores top insurance providers, and offers practical strategies to find the most competitive rates. We’ll explore the different companies, their offerings, and how to effectively compare quotes, empowering you to make an informed decision.

Texas drivers face a diverse range of insurance options. Understanding the nuances of coverage, discounts, and the overall market is key to maximizing savings. This guide aims to provide a clear and concise overview, making the process of comparing Texas car insurance rates straightforward and accessible.

Comparing Texas Car Insurance Companies: Compare Car Insurance Rates Texas

Source: cloudinary.com

Choosing the right car insurance provider in Texas is crucial for financial protection and peace of mind. Understanding the strengths and weaknesses of different companies allows you to make an informed decision tailored to your needs and circumstances. This comparison explores key aspects of top Texas insurance providers, including rates, discounts, and customer experiences.

Top 5 Car Insurance Providers in Texas

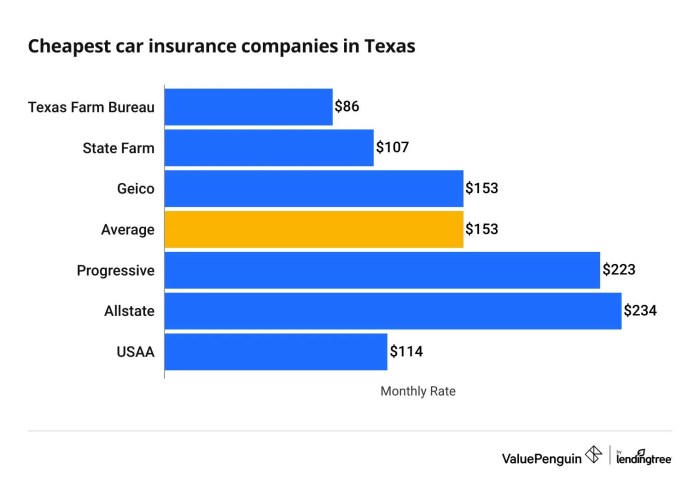

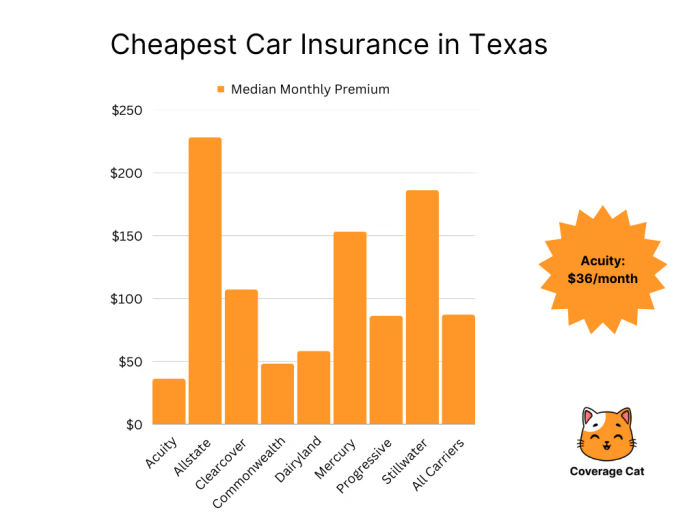

Texas boasts a competitive car insurance market. Several reputable companies serve the state, offering varying levels of coverage and pricing. The top five, often cited for their reach and influence, are: State Farm, Progressive, Geico, Allstate, and Liberty Mutual.

Average Rates by Vehicle Type

Insurance premiums often fluctuate based on vehicle type. Sedans generally have lower average rates compared to SUVs and trucks, due to factors such as size, weight, and theft risk. Insurance companies typically consider these elements when calculating premiums. For example, a compact sedan will usually have a lower premium than a large SUV, even if both vehicles have similar coverage options.

This variation reflects the higher potential for damage and repair costs associated with larger, more complex vehicles.

Discounts Offered by Insurance Companies

Many Texas car insurance providers offer a range of discounts to incentivize customer loyalty and encourage responsible driving habits. Multi-policy discounts, where customers bundle their insurance with other products, are common. Similarly, good student and safe driver discounts reward responsible driving behavior. For instance, a student with a good academic record and a clean driving history may qualify for a lower premium.

Customer Service Reviews

Customer experiences with various insurance companies can vary significantly. Online reviews provide valuable insights into the quality of customer service. Some companies might excel in claims processing, while others might be known for responsive customer support. For instance, some customers might praise State Farm’s straightforward claims process, while others might highlight Progressive’s quick response times to inquiries.

Conversely, negative reviews could mention difficulties in getting claims approved or slow responses to customer inquiries.

Comparative Analysis of Features

| Company | Average Rate (Example – Sedan) | Discounts Offered | Customer Reviews (Summary) |

|---|---|---|---|

| State Farm | $1500 | Multi-policy, good student, safe driver | Generally positive, praised for claims process, but some complaints about slow response times. |

| Progressive | $1600 | Multi-policy, accident forgiveness, good student | Positive reviews about quick claim resolution and responsive customer service. Some complaints about unclear policy language. |

| Geico | $1450 | Multi-policy, good student, safe driver, military discounts | Mixed reviews, some praise for affordability and ease of online tools, but others complain about complicated claims processes. |

| Allstate | $1700 | Multi-policy, good student, safe driver, defensive driving courses | Generally positive reviews regarding customer support, but some customers mention difficulties navigating the claims process. |

| Liberty Mutual | $1550 | Multi-policy, good student, safe driver, low mileage discounts | Positive feedback on digital tools and online claim filing, but some complaints about limited customer support options. |

Note: Average rates are examples and may vary based on individual circumstances. Customer reviews are a sample of online feedback and may not reflect all experiences.

Factors Influencing Car Insurance Rates in Texas

Source: millennialmoney.com

Understanding the factors that affect car insurance premiums in Texas is crucial for consumers. Knowing these factors allows individuals to make informed decisions about their coverage and potentially lower their costs. This section delves into the key elements that insurers consider when determining the price of a policy.Texas car insurance rates are not static; they fluctuate based on a multitude of variables.

These variables are often intertwined, meaning one factor can influence others and ultimately impact the overall cost of insurance. This complex interplay necessitates a detailed examination of each influencing factor.

Driving History

Driving history is a significant determinant in Texas car insurance rates. Insurers meticulously analyze a driver’s past driving record, including accidents, traffic violations, and claims history. A clean driving record, free of major infractions, usually translates to lower premiums. Conversely, a history of accidents or violations leads to higher premiums. For instance, a driver with multiple speeding tickets or an at-fault accident will likely face significantly higher premiums compared to a driver with no such incidents.

This is because insurers assess the risk of future claims based on past behavior. The severity and frequency of past incidents heavily influence the rate increase.

Location

Location plays a substantial role in determining car insurance premiums in Texas. Areas with higher crime rates, higher accident frequency, or poorer road conditions generally have higher insurance rates. For example, a driver living in a densely populated urban area with a history of traffic congestion and accidents might experience higher premiums than a driver residing in a rural area with fewer incidents.

Insurers assess the risk of accidents and claims based on the area’s specific characteristics. This is a critical factor, as the specific location within Texas greatly affects rates.

Vehicle Type

The type of vehicle also significantly impacts car insurance rates. The value, make, and model of a vehicle directly correlate to the cost of insurance. Luxury vehicles or high-performance cars are often more expensive to insure due to their higher replacement value and potential for damage or theft. Conversely, older, less expensive vehicles might have lower premiums.

The vehicle’s safety features also influence rates, with vehicles equipped with advanced safety technologies often having lower premiums. For instance, a new sports car will likely have a higher premium compared to a standard, economical car.

Age and Gender

Age and gender are also considered in the determination of insurance rates. Younger drivers, particularly those under 25, often face higher premiums than older drivers. This is because younger drivers are statistically more prone to accidents and claims. Gender differences in rates have become less pronounced in recent years, though some variations may still exist. Insurance companies collect and analyze data to identify risk profiles, which are then used to determine premium rates.

Table of Factors Affecting Insurance Premiums

| Factor | Description | Impact on Rates |

|---|---|---|

| Driving History | Accidents, violations, claims history | Higher rates for accidents/violations, lower rates for clean records |

| Location | Crime rates, accident frequency, road conditions | Higher rates in high-risk areas, lower rates in low-risk areas |

| Vehicle Type | Value, make, model, safety features | Higher rates for high-value/performance vehicles, lower rates for older/economical vehicles |

| Age and Gender | Driver’s age and gender | Higher rates for younger drivers, less pronounced gender differences |

Strategies for Finding the Best Texas Car Insurance

Source: typedream.com

Securing the most suitable car insurance in Texas involves a strategic approach. Understanding the available methods and employing effective comparison techniques are key to finding the most competitive rates. By combining online tools with personalized agent consultations, you can optimize your search and secure a policy that aligns with your specific needs and budget.

Methods for Comparing Car Insurance Quotes

Numerous avenues exist for comparing car insurance quotes in Texas. These include leveraging online comparison tools and directly contacting insurance agents. Each method offers distinct advantages and drawbacks, allowing for a tailored approach to finding the best rates.

Utilizing Online Comparison Tools, Compare car insurance rates texas

Online comparison tools are increasingly popular for comparing car insurance rates. These platforms aggregate quotes from multiple insurers, enabling quick and easy comparisons. Efficiently navigating these tools is vital for maximizing their potential.

- Thoroughly review the tool’s features, including the criteria used for quote generation.

- Provide accurate and complete information, including your driving history, vehicle details, and desired coverage options. Inaccurate input can lead to significantly different quotes.

- Compare multiple quotes side-by-side, paying close attention to premiums, deductibles, and coverage limits.

- Consider hidden fees or charges associated with specific coverages, as they can significantly impact the overall cost.

- Take advantage of any filters or advanced search options the tool provides to refine your search and target policies tailored to your requirements.

Contacting Insurance Agents

Insurance agents can provide personalized service and in-depth guidance during the policy selection process. Their expertise can prove invaluable when dealing with complex coverage options or navigating the intricacies of the Texas insurance market.

- Schedule a meeting with a local agent or use their online resources to get a preliminary quote.

- Clarify your insurance needs and preferences, discussing coverage amounts, deductibles, and desired add-ons.

- Ask questions about various coverage options and their implications. A thorough understanding of the policy is crucial.

- Request detailed explanations of any associated fees or hidden costs.

- Compare quotes from different agents representing various companies to ensure you’re receiving the most competitive rates.

Steps for Obtaining Quotes from Multiple Companies

A systematic approach to obtaining quotes from multiple insurance companies is crucial for securing the best possible rates. This often requires careful planning and organization.

- Compile a list of insurance companies operating in Texas, including both well-known brands and smaller, local providers.

- Utilize online comparison tools to obtain initial quotes from multiple companies. This helps establish a baseline for comparison.

- Contact insurance agents for quotes from additional companies. This allows for personalized guidance and potential negotiation of premiums.

- Compare all quotes meticulously, paying close attention to the specific coverage options and associated costs.

- Select the policy that aligns best with your needs and budget, carefully evaluating the total cost of coverage and the features offered.

Comparing Online Comparison Tools

A variety of online tools facilitates the comparison of Texas car insurance rates. Choosing the right tool can streamline the process.

| Tool | Features | Pros | Cons |

|---|---|---|---|

| Insurify | Comprehensive comparison, various coverage options, user-friendly interface | Wide range of quotes, easy navigation, tailored search options | Limited access to local agents, some features may require a premium account |

| Policygenius | Detailed breakdowns of coverage, helpful guides, personalized recommendations | Clear explanations of policies, helpful resources, personalized recommendations | May not offer the widest range of providers, could have less user-friendly interface for some users |

| QuoteWizard | Large selection of insurers, quick quote generation, straightforward design | Fast quotes, wide selection of insurers, straightforward design | May lack the level of customization found in other tools, fewer comparison options |

Ending Remarks

Source: insuredasap.com

In conclusion, comparing car insurance rates in Texas requires careful consideration of various factors. Understanding the different insurance providers, the impact of individual circumstances, and utilizing effective comparison tools are crucial steps. By following the strategies Artikeld in this guide, Texas drivers can confidently navigate the process and secure the most advantageous car insurance policies. Ultimately, this empowers you to make a financially sound decision that aligns with your needs and budget.

FAQs

What are some common discounts offered by Texas insurance companies?

Many companies offer discounts for safe driving, multi-policy holders, good student status, and more. Check the specific policies of the companies you’re considering.

How does my driving record affect my insurance rates?

A clean driving record generally leads to lower premiums. Accidents and violations will increase your rates significantly. Consistent safe driving practices are key.

Are there specific online tools to compare Texas car insurance quotes?

Yes, numerous online comparison tools are available. These tools can provide quick and easy comparisons of rates from different insurers, allowing you to identify the most affordable option.

What if I’m unsure which coverage options I need?

Consulting with an insurance agent is recommended. They can provide personalized guidance and help you understand the specific coverage types and limits suitable for your situation and vehicle.