Compare car insurance quotes Texas – it’s a crucial step in securing the best deal. Texas offers a wide array of insurance options, from liability to comprehensive coverage, each with its own cost. This guide will walk you through understanding Texas car insurance, comparing quotes online, and evaluating insurance providers to help you make an informed decision.

Navigating the Texas insurance market can be daunting. Different providers offer varying premiums, coverage packages, and discounts. This comprehensive resource will empower you to compare policies effectively, ensuring you find the most suitable insurance for your needs and budget.

Understanding Texas Car Insurance

Source: insuraviz.com

Texas car insurance is a complex system, with various factors influencing premiums and coverage options. Understanding these factors is crucial for securing the best possible policy and protecting your assets. This guide will cover key aspects of Texas car insurance, from coverage types and discounts to claim procedures and penalties for driving without insurance.

Factors Influencing Car Insurance Premiums

Several factors significantly impact the cost of car insurance in Texas. These include driving history, vehicle type, location, and even credit score. A clean driving record, with no accidents or traffic violations, usually results in lower premiums. Conversely, accidents or moving violations increase premiums substantially. The type of vehicle also plays a role; sports cars and trucks often have higher premiums compared to sedans due to perceived risk.

Location is important; higher-risk areas often have higher insurance rates. Finally, credit scores, though sometimes debated, can also be a factor, with some companies using credit scores as an indicator of risk.

Types of Car Insurance Coverage

Texas requires specific minimum coverage, but comprehensive coverage beyond the minimum offers more protection. Liability coverage protects you from financial responsibility if you cause an accident and injure someone else. Collision coverage pays for damage to your vehicle regardless of who caused the accident. Comprehensive coverage protects against damage to your vehicle from events other than collisions, such as vandalism, theft, or weather-related events.

Discounts Available to Texas Drivers

Numerous discounts can help reduce your car insurance premiums in Texas. Good student discounts are often available for drivers who maintain good grades in school. Multi-car discounts apply when multiple vehicles are insured with the same company. Safe driver discounts reward drivers with clean driving records. Bundling insurance with other services, such as home insurance, often yields discounts.

These discounts can vary significantly between insurance companies, so comparing policies is essential to find the best options.

Cost Comparison for Different Vehicle Types

The cost of insurance varies significantly based on the vehicle type. Sports cars, due to their higher perceived risk of damage and theft, typically have higher premiums than sedans. SUVs, often heavier and more expensive, may also carry higher premiums. Trucks, given their size and potential for damage, usually fall into a similar category. Comparing quotes from different insurers is vital for getting accurate estimates for each vehicle type.

Filing a Claim in Texas

Filing a claim in Texas involves several steps. Firstly, report the accident to the police, if necessary. Next, gather all relevant documentation, such as the police report, medical records, and witness statements. Contact your insurance company to initiate the claim process and follow their instructions meticulously. Be truthful and provide all necessary information to expedite the process.

Minimum Insurance Requirements by City

| City | Minimum Liability Coverage |

|---|---|

| Austin | $30,000 bodily injury per person, $60,000 bodily injury per accident, and $25,000 property damage |

| Dallas | $30,000 bodily injury per person, $60,000 bodily injury per accident, and $25,000 property damage |

| Houston | $30,000 bodily injury per person, $60,000 bodily injury per accident, and $25,000 property damage |

| San Antonio | $30,000 bodily injury per person, $60,000 bodily injury per accident, and $25,000 property damage |

Note: These are minimum requirements and you may want to consider higher limits for greater protection.

Penalties for Driving Without Insurance in Texas, Compare car insurance quotes texas

Driving without insurance in Texas carries significant penalties. These can range from hefty fines to potential imprisonment. The exact penalties can vary depending on the circumstances.

| Violation | Penalty |

|---|---|

| First Offense | Fines ranging from $500 to $2,000, and possible driver’s license suspension. |

| Subsequent Offenses | Higher fines, longer license suspensions, and potential court appearances. |

Driving without insurance is not only illegal but also carries significant financial and legal consequences.

Comparing Quotes Online: Compare Car Insurance Quotes Texas

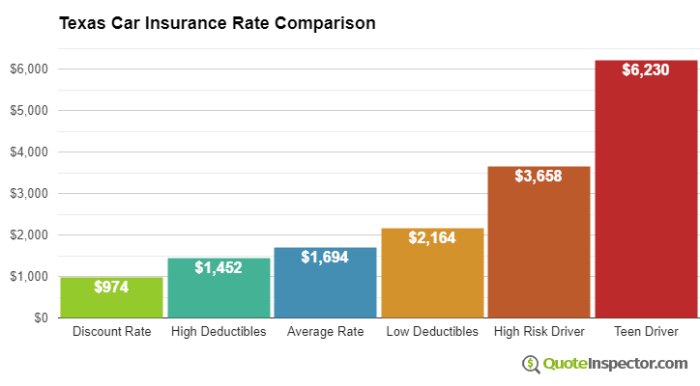

Source: quoteinspector.com

Comparing car insurance quotes online is a convenient and efficient way to find the best rates in Texas. It saves you time and effort by allowing you to see multiple options from various providers simultaneously. This approach is particularly useful given the diverse range of insurance companies offering varying coverage packages and premiums.Effective online comparison involves understanding the factors that influence premiums and knowing how to interpret the various coverages offered.

This allows you to make an informed decision and secure the most suitable policy for your needs. A structured approach to online quote comparisons is crucial for achieving this goal.

Methods for Effective Quote Comparison

Finding the right car insurance in Texas involves understanding the factors that influence rates. These include your driving record, vehicle type, location, and coverage choices. A systematic approach to comparing quotes involves a clear understanding of these elements and how they are reflected in the final price. By using comparison tools, you can quickly identify providers offering competitive premiums and coverage that meet your requirements.

Process for Searching and Comparing Quotes Online

A structured process simplifies the online quote comparison process. Begin by gathering essential information about your vehicle, driving history, and desired coverage. Next, visit multiple online car insurance quote comparison websites, providing accurate details to each site. Carefully review the quotes received, comparing premium costs and coverage options. Finally, evaluate the various discounts offered by each provider and compare the total cost of the insurance package.

Comparison of Popular Online Quote Comparison Websites

Several popular websites facilitate the comparison of car insurance quotes in Texas. These websites provide a platform to gather quotes from different insurers, allowing for easy price comparisons. Key features to look for in these websites include ease of use, comprehensive coverage options, and the ability to compare quotes from a wide range of insurers. Some popular sites include (but are not limited to) [Insert names of popular websites here].

Each site may have its own unique interface and features, but they generally offer similar functionalities.

Identifying and Utilizing Online Tools for Coverage Assessment

Online tools are available to help understand the specific coverages offered by different insurance companies. These tools often allow you to customize your coverage selections and view the impact on the premium. Understanding the different coverage options, such as liability, collision, comprehensive, and uninsured/underinsured motorist protection, is crucial. Reviewing the details of each coverage type will help you choose the most suitable protection for your situation.

Benefits of Comparing Multiple Quotes

Comparing multiple quotes from various providers offers several advantages. It helps you identify the most competitive premiums, enabling you to save money on your car insurance. It also provides the opportunity to compare different coverage options and choose the best fit for your needs. By comparing quotes, you can ensure you’re getting the most appropriate protection at the most favorable price.

Detailed Comparison of Quotes

| Company Name | Premium Cost | Coverage Details | Discounts Offered |

|---|---|---|---|

| InsCo1 | $1,200 | Liability, Collision, Comprehensive, Uninsured/Underinsured | Safe Driver, Multi-Car |

| InsCo2 | $1,150 | Liability, Collision, Comprehensive, Uninsured/Underinsured | Good Student, Bundled Services |

| InsCo3 | $1,300 | Liability, Collision, Comprehensive, Uninsured/Underinsured | Multi-Policy, Loyalty |

Factors Impacting the Accuracy of Online Quote Comparisons

Several factors can affect the accuracy of online quote comparisons. These include the accuracy of the information provided to the comparison websites, variations in coverage options, and the possibility of hidden fees. Be mindful that online quotes are estimates and may differ from the final price quoted by an insurer. Always verify the details with the insurer directly before making a decision.

Evaluating Insurance Providers

Source: website-files.com

Choosing the right car insurance provider in Texas involves more than just comparing prices. Thorough evaluation considers various factors, ensuring you select a company that aligns with your needs and offers a high level of service. This section details a structured approach to assessing insurance providers, including their financial stability, reputation, and customer service.

Assessing Provider Reputation

Insurance companies with strong reputations often indicate a commitment to customer satisfaction and fair practices. Positive reviews, both online and from personal accounts, offer valuable insights. Investigate customer service ratings, complaints filed with regulatory bodies, and industry recognition. A company’s history and community involvement also contribute to its reputation.

Evaluating Financial Strength

A financially stable insurance provider is crucial for your protection. Insurers must maintain sufficient reserves to meet their obligations. Several independent rating agencies assess insurance companies’ financial strength. Strong ratings indicate a lower risk of insolvency, allowing the company to fulfill claims as promised. Seek out and examine these ratings to gain insight into the provider’s stability.

Understanding Financial Stability Ratings

Texas insurance companies are evaluated by independent rating agencies. A strong financial rating indicates a company’s ability to pay claims, a crucial factor in choosing an insurer. Ratings typically range from Excellent to Poor, reflecting the company’s financial health and stability. The following table provides an overview of financial stability ratings for some prominent Texas insurance providers.

| Insurance Company | Rating Agency | Rating |

|---|---|---|

| State Farm | A.M. Best | Excellent |

| Geico | A.M. Best | Very Good |

| Progressive | A.M. Best | Good |

| Farmers Insurance | A.M. Best | Excellent |

| Liberty Mutual | A.M. Best | Very Good |

Note: Ratings and agencies may vary. Always verify the most current information directly from the rating agency.

Analyzing Policy Fine Print

Thorough review of policy terms is paramount. Hidden clauses or exclusions can significantly impact your coverage. Understanding the fine print will prevent unforeseen issues and ensure that the policy aligns with your needs. Look for clauses related to deductibles, exclusions, coverage limits, and policy exclusions. Carefully review each section to ensure you understand the implications of each term.

Verifying Licensing and Credentials

Verify the license and insurance credentials of any company operating in Texas. The Texas Department of Insurance provides a database of licensed insurers. Checking this database ensures the company is authorized to operate in the state and is adhering to regulatory standards. This process safeguards your investment and protects your rights as a policyholder.

Contacting Customer Service

Effective communication with customer service is essential for resolving concerns or addressing questions. Many insurance providers offer multiple channels for customer service, including phone, email, and online chat. Utilize these channels to obtain clarification or resolve any disputes. Understanding how to contact customer service representatives is crucial for resolving issues efficiently.

Assessing Customer Service Ratings

Independent review sites and consumer forums often publish customer service ratings for insurance providers. These ratings offer valuable insight into the responsiveness, helpfulness, and efficiency of the company’s customer service representatives. Compare these ratings to gain a better understanding of the quality of customer service from different providers.

Customer Service Contact Information

This table provides contact information and available customer service channels for some top Texas insurance providers. Utilize this information to directly interact with the company and assess their customer service capabilities.

| Insurance Company | Phone Number | Email Address | Website Chat |

|---|---|---|---|

| State Farm | (800) 222-4357 | [State Farm Email Address] | Yes |

| Geico | (800) 368-2734 | [Geico Email Address] | Yes |

| Progressive | (800) 776-4737 | [Progressive Email Address] | Yes |

Note: Contact information may vary; always confirm directly with the provider.

Final Review

Source: cloudinary.com

In conclusion, comparing car insurance quotes in Texas is a straightforward process when approached methodically. By understanding the various factors influencing premiums, utilizing online comparison tools, and evaluating providers based on reputation and financial stability, you can secure the best possible coverage. Remember to carefully review the fine print and consider your specific needs when selecting a policy.

Quick FAQs

How much does insurance typically cost in Texas for a young driver?

Insurance costs for young drivers in Texas are generally higher than for more experienced drivers due to a higher risk profile. Factors such as driving history and vehicle type will influence the specific premium amount.

What are the most common discounts available for Texas drivers?

Common discounts in Texas include good student discounts, multi-car discounts, and safe driving discounts. It’s advisable to check with individual providers for specific details.

Are there specific requirements for car insurance in different Texas cities?

Minimum insurance requirements vary by city in Texas. A comparison table in the guide provides details for common Texas cities.

What resources can I use to compare car insurance quotes online in Texas?

Several online comparison websites are readily available to compare car insurance quotes. The guide will detail popular websites and their features.