Cheap auto insurance for Florida is a crucial aspect of responsible car ownership in the Sunshine State. Navigating the market can feel overwhelming, but understanding the factors influencing rates and available options can significantly reduce your costs. This guide delves into the complexities of finding affordable insurance while maintaining adequate coverage.

Florida’s diverse insurance landscape offers a variety of providers and policies. This guide explores the different options available, from liability-only to full coverage, and provides strategies to compare policies and find the best deal. We’ll examine factors impacting your premiums, such as your driving record, vehicle type, and location, and reveal ways to potentially negotiate lower rates.

Introduction to Florida Auto Insurance

Source: autoinsurance.org

Florida’s auto insurance market is a dynamic landscape shaped by specific state regulations and the unique needs of its drivers. Understanding the factors that influence premiums and the available coverage options is crucial for securing the right policy. Navigating the system can be challenging, but armed with the right knowledge, you can find affordable and adequate protection.The cost of auto insurance in Florida, like elsewhere, is not a fixed number.

Several factors significantly impact premiums. These range from driver demographics to vehicle characteristics, and even the specific area of residence.

Factors Influencing Auto Insurance Premiums in Florida

Several key elements play a role in determining the price of your auto insurance policy in Florida. These are not just theoretical concepts; they directly affect the final cost.

- Driving Record: A clean driving record, free of accidents and traffic violations, is a significant factor in securing a lower premium. Drivers with a history of violations or accidents face higher premiums as they represent a higher risk to insurers. For instance, a driver with multiple speeding tickets might see a substantial increase in their premiums.

- Vehicle Type and Value: The make, model, and year of your vehicle play a part in your premium. Luxury vehicles or those known for high theft rates often attract higher premiums. Similarly, the value of your vehicle impacts your premium. Insurers consider the potential cost of repairs or replacement if your vehicle is damaged or stolen.

- Age and Gender of the Driver: Age and gender of the primary driver are often considered. Younger drivers, particularly males, are typically assigned higher premiums due to their higher accident risk. Statistical data often shows higher accident rates for specific age groups.

- Location and Coverage Options: Different areas of Florida may have varying rates due to local factors. For example, areas with a higher concentration of accidents or theft may have higher premiums. The specific coverage options chosen also impact the premium. Comprehensive and collision coverage, for example, generally result in higher premiums compared to basic liability coverage.

Types of Auto Insurance Coverage Available in Florida

Florida mandates specific types of coverage. Understanding these options allows informed decisions about the level of protection you need.

- Liability Coverage: This is required by law and protects you if you are found at fault in an accident. It covers the other party’s damages, up to the policy limits. It’s important to choose limits that adequately cover potential financial obligations. For example, a minimum liability policy might not adequately cover significant damage to another party’s vehicle.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or whose insurance coverage is insufficient. This coverage is crucial for your financial safety.

- Collision Coverage: This pays for damages to your vehicle regardless of who is at fault. It’s a valuable addition, especially if you want to protect your investment in your vehicle.

- Comprehensive Coverage: This coverage pays for damages to your vehicle from incidents other than collisions, such as vandalism, fire, or theft. Comprehensive coverage can protect against unexpected losses.

Common Misconceptions About Cheap Auto Insurance in Florida

Several misconceptions surround finding affordable auto insurance in Florida. Dispelling these myths helps consumers make informed decisions.

- Lowering coverage levels is always the best approach to save money: While reducing coverage can lead to lower premiums, it often compromises your protection in the event of an accident. Carefully consider the potential risks before making drastic reductions.

- Shopping online for quotes is a waste of time: Online tools and comparison websites provide quick and convenient access to multiple quotes from different insurance providers. This comparison is often beneficial to secure a better deal. It allows consumers to quickly identify competitive rates.

- Discounts are not available or not worth the effort: Numerous discounts are available to qualifying drivers, such as discounts for good driving records, safe driving courses, or multiple vehicles. Many drivers can save substantial amounts through discounts.

Identifying Cost-Effective Insurance Options: Cheap Auto Insurance For Florida

Source: cloudinary.com

Finding affordable auto insurance in Florida involves careful consideration of various factors. Understanding the different providers, policies, and available discounts is crucial for securing the best possible rates. This section will delve into the specifics of identifying cost-effective insurance options.A multitude of insurance companies operate in Florida, each with its own pricing strategies. Analyzing these strategies and comparing policies based on coverage levels and discounts can significantly impact the final premium.

Understanding the nuances of Florida’s insurance market empowers drivers to make informed choices.

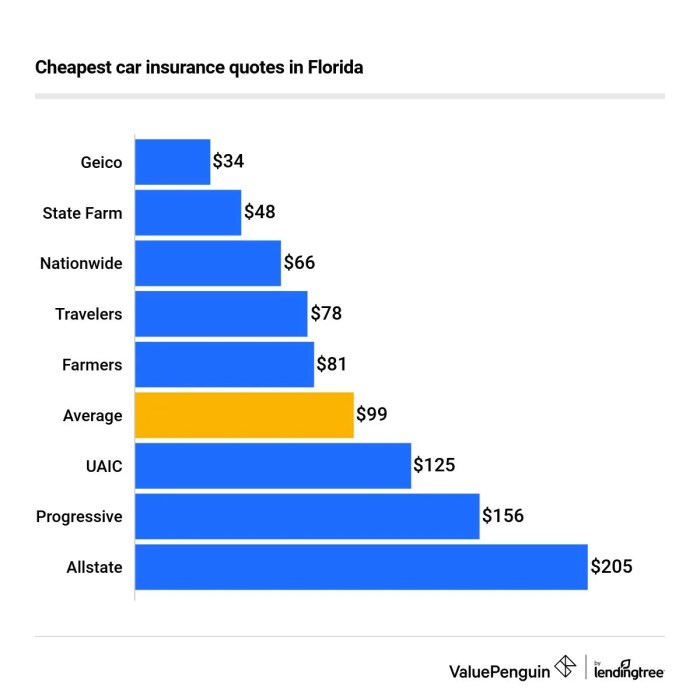

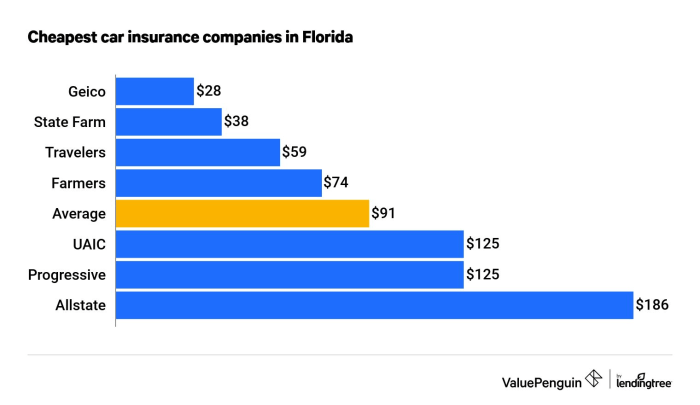

Insurance Provider Comparisons

Several well-established insurance companies compete for Florida drivers. Comparing their offerings is key to identifying competitive rates. Factors such as claims handling, customer service reputation, and financial stability should also be considered alongside price. Different insurers may have varying strengths and weaknesses.

Policy Comparison Focusing on Cost

Various insurance policies cater to different needs and budgets. Comparing policies involves analyzing liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Understanding the nuances of each type of coverage helps drivers choose a policy that aligns with their financial situation and driving habits. A policy that covers the basics while remaining affordable is often a smart option.

For example, a policy with lower collision and comprehensive coverage may be suitable for drivers who drive cautiously and prefer lower premiums.

Discounts for Florida Drivers

Florida drivers can leverage numerous discounts to reduce their insurance premiums. These discounts can significantly impact the final cost. Discounts are often available for safe driving habits, vehicle safety features, defensive driving courses, and more. Bundling insurance with other services such as home or renters insurance might also offer savings. For instance, a driver who has maintained a clean driving record and has installed anti-theft devices in their vehicle might qualify for discounts.

Efficient Quote Comparison

Comparing quotes from multiple insurance providers is essential for securing the best rate. Utilizing online comparison tools and contacting insurers directly are efficient methods for obtaining multiple quotes. These tools allow users to input their specific details and receive instant quotes from various providers. Comparison tools can also help in finding discounts that are tailored to the driver’s specific situation.

Many sites will let you filter by coverage type, discounts available, and insurance company reputation.

Insurance Provider Rate Comparison Table, Cheap auto insurance for florida

| Insurance Provider | Liability Coverage (Min.) | Collision Coverage (Min.) | Comprehensive Coverage (Min.) | Uninsured/Underinsured Motorist (Min.) | Estimated Premium (Annual) |

|---|---|---|---|---|---|

| Company A | $100,000 | $100,000 | $100,000 | $100,000 | $1,200 |

| Company B | $250,000 | $50,000 | $50,000 | $250,000 | $1,500 |

| Company C | $300,000 | $100,000 | $100,000 | $300,000 | $1,800 |

Note: This table is for illustrative purposes only and premiums can vary based on individual factors.

Factors Affecting Insurance Premiums in Florida

Source: cloudinary.com

Florida’s auto insurance landscape is influenced by a complex interplay of factors. Understanding these factors is crucial for consumers seeking cost-effective policies. This section details the key elements that impact your insurance rates, empowering you to make informed decisions.

Driving Record and History

A clean driving record is paramount in securing favorable insurance rates. Insurance companies assess driving history, including traffic violations, accidents, and claims. A history of speeding tickets, reckless driving, or accidents can significantly increase premiums. This is because such incidents demonstrate a higher risk of future claims. Conversely, drivers with a history of safe driving practices enjoy lower premiums.

For example, a driver with multiple speeding tickets will likely pay more than a driver with a clean record.

Vehicle Type and Model

The type and model of your vehicle directly affect your insurance premiums. High-performance sports cars, luxury vehicles, and those with high theft rates tend to have higher insurance premiums than standard vehicles. The vehicle’s value and potential for damage also influence the cost. Insurance companies consider the vehicle’s make, model, year, and features when determining premiums. For instance, a high-end sports car is more expensive to insure than a basic economy car.

This is often due to factors such as the car’s repair costs, potential for theft, and the possibility of damage during an accident.

Location and Demographics

Geographic location plays a significant role in Florida’s auto insurance rates. Areas with higher crime rates or accident frequency typically experience higher premiums. Demographic factors, such as population density and the age profile of drivers in a specific region, can also affect insurance costs. This is because high-crime areas or those with a concentration of younger drivers might experience more accidents.

For instance, a driver living in a high-crime area of a major city in Florida might pay a higher premium than a driver living in a rural area with fewer reported incidents.

Age and Gender

Insurance companies often use age and gender as factors in determining premiums. Younger drivers are generally assigned higher premiums compared to older drivers. This is due to the higher accident rates associated with inexperienced drivers. Similarly, there are slight differences in rates based on gender, though these factors are becoming less prominent. For instance, a 16-year-old driver will typically have a higher premium than a 30-year-old driver.

Correlation Between Factors and Insurance Premiums

| Factor | Impact on Premiums | Example |

|---|---|---|

| Driving Record (clean) | Lower premiums | A driver with no accidents or violations will likely pay less. |

| Vehicle Type (high-performance car) | Higher premiums | A sports car with a high value and potential for damage will have a higher premium. |

| Location (high-crime area) | Higher premiums | A driver in an area with a high crime rate will likely pay more. |

| Age (young driver) | Higher premiums | A 16-year-old driver will typically pay more than a 30-year-old driver. |

Strategies for Obtaining Affordable Insurance

Source: cloudinary.com

Securing affordable auto insurance in Florida involves a proactive approach that combines negotiation tactics, smart policy bundling, and careful comparison of coverage options. Understanding the factors influencing premiums and tailoring your policy to your specific needs are crucial steps toward saving money.

Negotiating Insurance Premiums

Negotiation is a valuable tool in securing favorable insurance rates. Insurers often respond positively to evidence of good driving history and safe driving practices. Presenting a comprehensive driving record, including accident-free years and a clean driving history, can strengthen your position during negotiations. Proactively contacting your current provider and expressing interest in potentially lower premiums can be an effective strategy.

This can be done through a phone call, email, or in-person visit. Be prepared to discuss any recent driving improvements, such as taking defensive driving courses, or any modifications to your vehicle.

Bundling Insurance Policies

Bundling your auto insurance with other policies, such as home or renters insurance, can frequently lead to significant discounts. This strategy leverages the insurer’s economies of scale, making it advantageous for both the customer and the company. A single insurer managing multiple policies for a customer often results in a lower overall cost, passed on to the consumer as a discount.

A customer who insures their home and car with the same company, for instance, often receives a substantial discount on both policies.

Comparing Coverage Options

Comparing different coverage options is essential to ensure you’re getting the best possible value for your money. It’s important to analyze coverage levels without compromising necessary protection. Understanding the different levels of coverage, from liability to comprehensive, helps in making informed decisions. Consider the cost-benefit relationship of various coverage options, ensuring you are not paying for unnecessary features.

This involves understanding the differences in deductibles, policy limits, and coverage amounts.

Optimizing Policies Based on Individual Needs

Optimizing your insurance policy involves tailoring it to your specific needs and circumstances. Factors like your driving habits, location, and vehicle type all play a role in determining the appropriate coverage. Consider your driving habits, the number of miles you drive, and the location of your residence and commute. Factors like the type of vehicle, and any additional driver(s) should be taken into account when determining your needs.

Adjusting coverage levels, based on these factors, helps you avoid overpaying for protection you don’t need.

Step-by-Step Guide to Obtaining Cheap Auto Insurance in Florida

This guide provides a structured approach to securing affordable auto insurance in Florida:

- Assess Your Driving Record and Vehicle: Review your driving history, noting any accidents or traffic violations. Evaluate your vehicle’s value and make sure the details are accurately represented to insurers.

- Research and Compare Policies: Use online comparison tools to obtain quotes from multiple insurers. Evaluate the different coverage options, and note any discounts.

- Negotiate with Insurers: Contact your current insurer or prospective insurers to explore potential discounts or lower premiums. Present your case based on your good driving record or any recent improvements.

- Bundle Policies (if applicable): Explore the possibility of bundling your auto insurance with other policies, such as home or renters insurance, to secure potential discounts.

- Optimize Your Policy: Adjust coverage limits and deductibles based on your needs and financial situation. This will help you avoid overpaying for protection you may not need.

- Review and Reassess: Periodically review your insurance policy to ensure it still meets your needs. Consider any changes in your driving habits, vehicle, or financial situation.

Understanding Coverage Options in Florida

Choosing the right auto insurance coverage in Florida is crucial for protecting yourself and your vehicle. Understanding the different types of coverage available, and their associated costs, allows you to make informed decisions that align with your financial situation and driving needs. This section delves into the essential coverage options, highlighting their significance and potential impact on your premiums.

Liability Insurance in Florida

Florida mandates liability insurance, meaning you’re legally required to carry this coverage. Liability insurance protects you from financial responsibility if you’re at fault in an accident, covering damages to the other party’s vehicle and injuries they sustain. The minimum required coverage in Florida is $10,000 for bodily injury per person, $20,000 for bodily injury per accident, and $10,000 for property damage.

However, carrying this minimum amount of coverage is often insufficient, especially given rising accident costs. It’s highly recommended to purchase significantly higher liability limits to adequately protect your assets.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended. Collision coverage pays for damages to your vehicle if it’s involved in an accident, regardless of who is at fault. Comprehensive coverage pays for damages to your vehicle caused by events other than collisions, such as vandalism, theft, fire, hail, or weather events. Without these coverages, you could be responsible for substantial out-of-pocket expenses if your vehicle is damaged or stolen.

For example, a severe hail storm could damage multiple vehicles in a neighborhood, leaving owners with hefty repair bills without comprehensive coverage.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection (UM/UIM) is vital. This coverage steps in if you’re involved in an accident with an at-fault driver who doesn’t have adequate insurance or is uninsured. It provides compensation for your injuries and vehicle damages in such scenarios. Without this coverage, you could face financial hardship if you’re injured in an accident caused by an uninsured driver.

This is especially important in Florida, where the number of uninsured drivers can be a concern.

Supplemental Coverage Options

Several supplemental coverage options are available to enhance your auto insurance protection. These add-ons can provide further financial security and peace of mind. Examples include rental reimbursement, roadside assistance, and medical payments. Rental reimbursement covers the cost of a rental car if your vehicle is damaged or involved in an accident. Roadside assistance provides assistance in situations such as a flat tire or a dead battery.

Medical payments cover your medical expenses if you or a passenger is injured in an accident, regardless of fault.

Breakdown of Coverage Types and Costs

| Coverage Type | Description | Typical Cost Impact |

|---|---|---|

| Liability | Covers damages to others in an accident you cause. | Generally lower cost than other coverages. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Can vary significantly based on vehicle make, model, and repair costs. |

| Comprehensive | Covers damage to your vehicle from non-collision events. | Can vary significantly based on vehicle make, model, and potential risks. |

| Uninsured/Underinsured Motorist | Covers damages if you’re involved in an accident with an uninsured or underinsured driver. | Can be a substantial cost depending on coverage limits. |

| Rental Reimbursement | Covers rental car costs if your vehicle is damaged or involved in an accident. | Usually a small additional cost. |

| Roadside Assistance | Provides assistance in situations like flat tires or dead batteries. | Usually a small additional cost. |

| Medical Payments | Covers medical expenses for you and your passengers in an accident. | Usually a small additional cost. |

Online Resources and Tools for Comparison

Finding the best Florida auto insurance rates often involves comparing quotes from multiple providers. Online resources and comparison tools are valuable assets in this process, streamlining the search and potentially saving you money. These tools allow you to input your specific needs and circumstances, and receive tailored quotes from various insurance companies.Online comparison platforms offer a structured way to assess the different options available, helping you navigate the complexities of the Florida insurance market.

By comparing quotes, you can quickly identify potentially more affordable plans and make informed decisions.

Popular Online Comparison Platforms

Online platforms dedicated to comparing insurance quotes have become increasingly popular. These platforms typically aggregate quotes from multiple insurance companies, providing a comprehensive overview of available options. Key features often include personalized questionnaires, detailed policy breakdowns, and tools for filtering results based on specific criteria. This makes it easier to locate a policy that fits your particular needs and budget.

Reliable Websites for Unbiased Comparisons

Several websites strive to provide unbiased comparisons of insurance policies. These sites typically employ algorithms or methodologies to compare policies fairly, ensuring transparency and minimizing bias. Look for sites that clearly Artikel their comparison process and disclose any potential conflicts of interest. Independent review sites can be a good source for assessing the reliability of these comparison platforms.

Pros and Cons of Using Online Tools

Online tools for finding cheap insurance offer significant advantages. They often save time by quickly presenting numerous options. Comparison tools frequently provide comprehensive information about different policies, enabling more informed decision-making. However, users should exercise caution. Some online tools might have hidden fees or limited coverage.

It is crucial to carefully review the terms and conditions of any policy before committing.

Trusted Comparison Websites

- Insurify: Insurify is a well-regarded comparison platform that offers a straightforward process for finding quotes from multiple insurers. Users input their information, and the platform returns customized quotes based on their needs.

- Policygenius: Policygenius is another reputable option for comparing Florida auto insurance. It offers a user-friendly interface and provides detailed policy breakdowns to help you understand the various coverages.

- NerdWallet: NerdWallet’s insurance comparison tool provides a wide range of options for auto insurance. It emphasizes transparency and clear explanations of different policies.

These sites offer a range of services, including customized quotes, comparisons, and potentially additional resources to help consumers make informed choices. Reviewing the site’s terms of service and user reviews can provide further insight into their reliability and user experience.

Verifying Reliability of Online Comparison Tools

“Before relying on any online comparison tool, always check its reputation and the methodology used for comparing policies. Look for sites that clearly Artikel their comparison process, and avoid tools with unclear or hidden fees.”

Thorough research into a comparison tool’s methodology and customer reviews can help ensure that the information presented is accurate and reliable. Reviewing customer testimonials or online reviews can also provide valuable insight into the platform’s performance. This can aid in identifying potential issues or concerns associated with a particular comparison tool.

Practical Tips for Finding Cheap Auto Insurance

Securing affordable auto insurance in Florida requires proactive strategies. Understanding the factors influencing premiums and implementing smart choices can significantly reduce your insurance costs. By regularly reviewing your policy, obtaining multiple quotes, and maintaining a safe driving record, you can optimize your coverage and save money.Finding the best deal on auto insurance often involves more than just selecting a provider.

It requires a comprehensive approach that considers your individual needs and driving habits. This section will provide practical tips to help you navigate the process and find the most cost-effective insurance options available in Florida.

Regular Policy Review and Updates

Regularly reviewing your insurance policy is crucial for ensuring it aligns with your current needs and circumstances. Changes in your driving habits, lifestyle, or vehicle can impact your premium. For instance, if you move to a safer neighborhood or get a more fuel-efficient vehicle, your rates might decrease. Conversely, if you start commuting more frequently or have a new driver in the household, your rates might increase.

A proactive review ensures your policy remains competitive and appropriate for your situation.

Obtaining Multiple Quotes from Various Providers

Comparing quotes from multiple insurance providers is a fundamental step in finding affordable auto insurance. Different companies have varying pricing structures and coverage options. By obtaining quotes from several providers, you gain a comprehensive understanding of available rates and coverage levels. This allows you to identify the best possible value and choose the most cost-effective option. This comparison process can often uncover significant savings.

Maintaining a Good Driving Record

Maintaining a clean driving record is paramount to reducing your auto insurance premiums. Traffic violations, accidents, and claims can dramatically increase your rates. A consistent history of safe driving demonstrates responsible behavior, making you a lower-risk driver in the eyes of insurers. Insurance companies reward safe drivers with lower premiums. For example, a driver with a clean record and a low accident frequency is likely to qualify for discounts and lower premiums.

Choosing the Right Deductible

Selecting the right deductible plays a vital role in shaping your insurance costs. A higher deductible typically translates to lower premiums, as it shifts a greater financial responsibility to the policyholder in the event of a claim. However, this means you’ll need to pay more out-of-pocket if you file a claim. Carefully weigh the potential savings against the amount you’re comfortable paying in the event of an accident.

The optimal deductible is one that balances affordability with financial preparedness.

Questions to Ask Insurance Providers

Before committing to an insurance policy, asking clarifying questions to the provider is essential. This proactive approach allows you to fully understand the policy terms and conditions, identify potential savings, and ensures you make an informed decision. It’s crucial to clarify the specifics of coverage, discounts, and any hidden fees or exclusions.

- Clarify the details of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Inquire about any discounts available, such as safe driver discounts, anti-theft device discounts, or multi-policy discounts.

- Understand the claims process and how long it takes to process a claim.

- Ask about the policy’s cancellation and renewal procedures.

- Request a breakdown of the premium and understand how various factors influence the cost.

Illustrative Examples of Different Insurance Policies

Finding the right auto insurance policy often feels like navigating a maze. Different options cater to various needs and budgets, so understanding the specifics is crucial. This section will Artikel several common policies, highlighting their coverage, costs, and suitability.Different insurance policies offer varying levels of protection, and the best choice depends on individual circumstances and risk tolerance. Consider your driving habits, vehicle type, and financial situation when evaluating the options.

Liability-Only Policies

This policy provides the minimum coverage required by law. It typically protects you from financial responsibility if you cause an accident and injure someone else or damage their property. However, it does not cover your own vehicle damage or medical expenses. This is often the most budget-friendly option, but it’s important to recognize the limitations.

Comprehensive Policies

This policy is a more robust option, providing broader coverage than liability-only. It covers your vehicle in case of damage from various perils beyond accidents, such as vandalism, fire, or theft. Comprehensive policies usually include collision coverage, which protects your vehicle if it’s involved in a collision, regardless of who is at fault.

Full Coverage Policies

A full coverage policy combines liability, collision, and comprehensive coverage. This offers the most comprehensive protection, safeguarding your vehicle and financial well-being in most scenarios. It’s generally the most expensive option, but it can offer peace of mind for those who prioritize full protection.

Comparing Policy Examples with Deductibles

The amount you pay out-of-pocket before your insurance kicks in is known as the deductible. Different policies and coverage levels will have various deductibles. Lower deductibles usually mean lower premiums but higher out-of-pocket costs in case of a claim. Higher deductibles mean lower premiums and lower out-of-pocket costs, but you are responsible for more of the cost in case of an accident.

| Policy Type | Coverage | Typical Cost (Example) | Deductible (Example) |

|---|---|---|---|

| Liability-Only | Covers damage to others’ property and injuries. Does not cover your vehicle. | $50-$200 per month | N/A (varies by state) |

| Comprehensive | Covers damage to your vehicle from perils beyond accidents (e.g., vandalism, fire, theft). | $75-$250 per month | $250, $500 |

| Full Coverage | Combines liability, collision, and comprehensive coverage. Offers the most protection. | $150-$400 per month | $250, $500, $1000 |

Note: Costs are examples and can vary widely based on factors like your driving record, vehicle type, location, and more.

Last Recap

Source: taps150.org

Finding cheap auto insurance for Florida involves careful consideration of various factors and a proactive approach. By understanding the market, comparing quotes, and optimizing your coverage, you can secure a policy that aligns with your needs and budget. Remember to review and update your policy regularly, and utilize available resources to maintain affordability and peace of mind on the road.

Query Resolution

What are the most common misconceptions about cheap auto insurance in Florida?

Many believe a cheaper policy means less coverage. In reality, understanding your needs and comparing various policy options is key to securing the right balance of protection and cost.

How do I efficiently compare quotes from multiple insurance providers?

Online comparison tools are a great resource. Utilize these platforms to collect quotes from different providers quickly and effectively. Also consider contacting providers directly for personalized quotes.

What discounts are available for Florida drivers that can reduce premiums?

Many providers offer discounts for safe driving, multi-policy bundling, and defensive driving courses. Check with different providers to see which discounts apply to you.

What is the role of driving record and history in determining insurance rates?

A clean driving record generally leads to lower premiums. Accidents and violations can significantly increase your rates, so responsible driving habits are essential.