Compare auto insurance quotes in Texas to find the best rates. Texas has a diverse auto insurance market, with many factors influencing premiums. This guide walks you through the process of finding the most suitable policy for your needs.

Understanding the various insurance types available in Texas, like liability, collision, and comprehensive, is crucial. Factors such as your driving record, vehicle type, and location significantly impact your premiums. This detailed overview will equip you with the knowledge to navigate the Texas auto insurance landscape confidently.

Introduction to Auto Insurance in Texas: Compare Auto Insurance Quotes In Texas

Source: insurancequotes.com

Texas drivers face a complex auto insurance landscape, where navigating the various coverage options and understanding the factors affecting premiums is crucial. This overview will clarify the different types of insurance available and highlight the key elements that influence the cost of your policy. Comprehending these factors empowers you to make informed decisions when comparing quotes.

Texas Auto Insurance Market Overview

The Texas auto insurance market is characterized by a competitive environment with numerous insurers vying for customers. This competition often leads to varying rates and coverage options. While the state has regulations governing minimum coverage requirements, the specific coverage and premiums offered can differ substantially between companies.

Types of Auto Insurance Coverage in Texas

Texas law mandates specific types of coverage for all licensed drivers. These essential coverages are designed to protect drivers and their vehicles. Beyond the required minimums, drivers often opt for additional coverage to address potential financial burdens in the event of accidents. Understanding the specific details of each coverage type is vital for tailoring your insurance to your needs.

- Liability Coverage: This protects you if you are at fault in an accident and cause damage to another person’s vehicle or injury to another person. It typically covers the costs of repairing the other party’s vehicle and paying for medical expenses.

- Collision Coverage: This coverage pays for damage to your vehicle regardless of who is at fault in an accident. It’s often an optional add-on to protect your investment in your vehicle.

- Comprehensive Coverage: This covers damage to your vehicle from incidents other than collisions, such as theft, vandalism, fire, or hail. This is a valuable safeguard against unexpected damage.

- Uninsured/Underinsured Motorist Coverage: This is crucial if you’re involved in an accident with a driver who lacks insurance or whose insurance limits are insufficient to cover the damages. It steps in to provide protection in such scenarios.

Factors Influencing Auto Insurance Premiums in Texas

Several factors influence the cost of your auto insurance in Texas. A thorough understanding of these elements helps you analyze and potentially reduce your premiums.

- Driving Record: A clean driving record, free of accidents and traffic violations, generally leads to lower premiums. Accidents and speeding tickets, conversely, can significantly increase your rates.

- Vehicle Type: The make, model, and year of your vehicle, along with its features, can affect your premiums. Sports cars or vehicles with high repair costs often result in higher insurance costs.

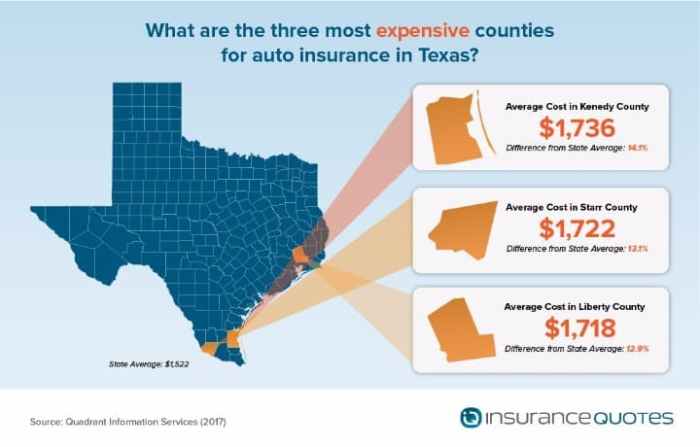

- Location: Areas with higher accident rates or higher concentrations of theft incidents tend to have higher insurance premiums. Urban areas, for example, often have higher premiums than rural areas.

- Age and Gender: Age and gender are considered by insurers, and these factors often affect premiums. Younger drivers, particularly males, generally face higher premiums compared to older, female drivers. This is due to statistics showing higher accident rates among younger drivers.

Minimum Coverage Requirements in Texas

The following table Artikels the minimum insurance coverage requirements in Texas, by category. Understanding these requirements helps you ensure compliance with state regulations.

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability (BIL) | $30,000 per person, $60,000 per accident |

| Property Damage Liability (PDL) | $25,000 per accident |

Finding Quotes

Source: autoinsurance.org

Securing the right auto insurance in Texas involves more than just choosing a provider. A crucial step is comparing quotes to find the most suitable coverage at the best price. This process can be streamlined with various methods and tools available.Finding the best auto insurance deal in Texas requires careful consideration of various factors, including coverage needs, driving history, and financial situation.

By utilizing comparison tools and understanding the different quote-gathering methods, Texans can make informed decisions about their auto insurance.

Common Methods for Obtaining Quotes

Several avenues exist for obtaining auto insurance quotes in Texas. Directly contacting insurance providers, using online comparison tools, and seeking recommendations from friends and family are all common methods. Direct contact can yield personalized service, but it may involve more time and effort. Online comparison tools offer a convenient way to quickly gather quotes from multiple companies.

Recommendations can provide insight based on personal experiences, but they don’t guarantee the most suitable coverage.

Steps Involved in Comparing Quotes Online

Comparing auto insurance quotes online is generally a straightforward process. Typically, you start by providing basic information about your vehicle, driving history, and desired coverage. Online quote comparison websites then present various options from different insurance providers. After reviewing these options, you can compare premiums, coverage details, and other relevant factors to select the best fit for your needs.

Crucially, thoroughly review all the fine print before making a decision.

Importance of Comparing Quotes from Multiple Providers

Comparing quotes from multiple insurance providers is crucial for securing the most competitive rates. Different providers may have varying pricing structures and coverage options. Comparing multiple quotes allows you to identify the most affordable and suitable policy. This process helps you avoid overpaying for insurance and ensures you have the appropriate coverage for your needs.

Online Quote Comparison Websites

Numerous online platforms specialize in comparing auto insurance quotes in Texas. These websites streamline the process by aggregating quotes from various providers in a single location. Using these websites saves time and effort by consolidating the comparison process.

| Website | Description |

|---|---|

| Insurify | Insurify is a popular online comparison tool that aggregates quotes from multiple insurance companies. |

| Policygenius | Policygenius provides a user-friendly platform to compare auto insurance quotes from various providers. |

| NerdWallet | NerdWallet’s comparison tool offers a broad range of insurance options, including auto insurance, making it a comprehensive resource. |

| QuoteWizard | QuoteWizard aggregates quotes from multiple insurance companies, allowing for easy comparison. |

Benefits of Using Online Tools to Compare Quotes

Online tools offer significant advantages in the process of comparing auto insurance quotes. These tools save time by consolidating quotes from various providers, facilitating quick comparisons. They also help you find the best possible rates and coverage options, leading to potential cost savings. The availability of various filters and criteria further refines the search to match specific needs and preferences.

Key Considerations When Comparing Quotes

Comparing auto insurance quotes in Texas involves more than just picking the lowest price. Understanding the nuances of coverage options, policy terminology, and financial implications is crucial for making an informed decision. Careful consideration of these factors ensures you’re adequately protected without overpaying.

Coverage Details

Understanding the specific details of each coverage option is paramount. Liability coverage protects you from financial responsibility if you cause an accident, but it doesn’t cover damages to your own vehicle. Collision and comprehensive coverage address these aspects, providing financial protection against damage to your car, regardless of who is at fault. A comprehensive policy covers incidents like vandalism, theft, or weather-related damage, while collision coverage addresses damage from an accident.

Thorough examination of each coverage component is necessary to ensure alignment with your needs and circumstances.

Coverage Comparison

| Coverage Type | Description | Example |

|---|---|---|

| Liability | Protects you from financial responsibility if you cause an accident. | Pays for damages to other vehicles or injuries to others. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Pays for repairs if your car is damaged in a collision, even if you were at fault. |

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as vandalism, theft, or weather. | Covers your car if it’s damaged in a hail storm or stolen. |

This table provides a basic overview of the various coverage types. It’s essential to review the specifics of each policy to determine the best fit for your needs. Note that some policies may have limitations or exclusions.

Policy Terminology

Decoding policy terminology is vital for understanding the terms and conditions. Familiarize yourself with terms like “deductible,” “policy limits,” “uninsured/underinsured motorist coverage,” and “diminution of value.” Understanding these terms will help you select the most appropriate policy for your circumstances. For example, a higher deductible may lead to lower premiums, but you’ll need to pay more out-of-pocket in the event of a claim.

Deductibles and Policy Limits

Deductibles and policy limits are crucial financial considerations. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Lower deductibles mean higher premiums, while higher deductibles lead to lower premiums. Policy limits define the maximum amount the insurance company will pay for a claim. Understanding these limits helps ensure that your coverage aligns with your potential needs.

Consider that higher policy limits generally mean higher premiums.

Comparing Policy Limits

Comparing policy limits across various providers requires careful analysis. Assess the coverage amounts for liability, collision, and comprehensive, factoring in potential damages to your vehicle and potential injuries to others. Use online comparison tools or contact insurance agents to gain insight into policy limits across various providers. Review policy documents carefully to avoid any surprises. For example, a policy with higher limits for bodily injury liability may be more suitable if you anticipate higher potential claims.

Remember, policy limits are essential in safeguarding your financial well-being in the event of an accident.

Understanding Texas Insurance Regulations

Texas auto insurance regulations are designed to protect both insurers and policyholders. Understanding these regulations is crucial for consumers to make informed decisions when comparing quotes and selecting coverage. This section details the oversight of the Texas Department of Insurance, consumer protections, and complaint procedures. It also presents a summary of relevant Texas insurance laws.Texas insurance regulations are established to ensure fair and equitable practices within the insurance industry.

The regulations are aimed at promoting consumer confidence and protecting policyholders from potentially harmful or deceptive insurance practices.

Role of the Texas Department of Insurance

The Texas Department of Insurance (TDI) plays a critical role in overseeing and regulating the insurance industry in Texas. This includes ensuring that insurance companies comply with state laws and regulations. The TDI is responsible for investigating complaints, conducting examinations of insurance companies, and enforcing insurance laws. The agency aims to maintain a level playing field for all stakeholders involved in the insurance industry.

Consumer Protections in Texas

Texas law provides various protections for consumers in the auto insurance market. These protections aim to prevent unfair or deceptive practices by insurance companies. Examples of such protections include regulations on premium rates, policy terms, and claims handling procedures. Consumers are entitled to fair treatment and clear communication throughout the insurance process.

Filing Complaints

Policyholders who experience issues with their auto insurance coverage in Texas can file complaints with the Texas Department of Insurance. The process typically involves submitting a formal complaint outlining the specific issue. The TDI then investigates the complaint and takes appropriate action to address any violations of the law. The TDI’s website provides detailed information and instructions on how to file a complaint.

Summary of Texas Auto Insurance Laws and Regulations

| Area of Regulation | Key Regulations |

|---|---|

| Premium Rates | Regulations exist to ensure premiums are not excessive and are based on factors such as risk assessment and actuarial data. |

| Policy Terms | Clear and comprehensive policy terms are required. Consumers must be informed of their rights and responsibilities under the policy. |

| Claims Handling | Procedures for handling claims must be transparent and efficient. Timeframes for processing claims are often regulated. |

| Unfair Trade Practices | Laws prohibit insurance companies from engaging in unfair, deceptive, or discriminatory practices. |

This table summarizes some key areas of Texas auto insurance regulation. It is not exhaustive and other regulations may exist. Consulting the Texas Department of Insurance website for the most up-to-date information is highly recommended.

Comparison with Other States

Regulations surrounding auto insurance vary across states. Some states may have stricter regulations on premium rates, while others may have different requirements for policy terms. Comparing Texas regulations with those of other states is crucial when deciding where to obtain insurance. For example, Texas may have different claim handling procedures compared to neighboring states. Understanding the specific requirements in different states allows for a more informed comparison of insurance options.

Analyzing Insurance Providers in Texas

Choosing the right auto insurance provider in Texas is crucial for securing affordable and comprehensive coverage. Understanding the different companies, their track records, and financial stability can significantly impact your decision-making process. This analysis will delve into prominent Texas insurance providers, examining their history, reputation, and financial strength ratings to help you make an informed choice.

Prominent Auto Insurance Providers in Texas

Texas boasts a diverse range of auto insurance providers. Evaluating these providers allows you to compare offerings and choose the most suitable option. Recognizing their strengths and weaknesses is key to finding the best fit for your needs.

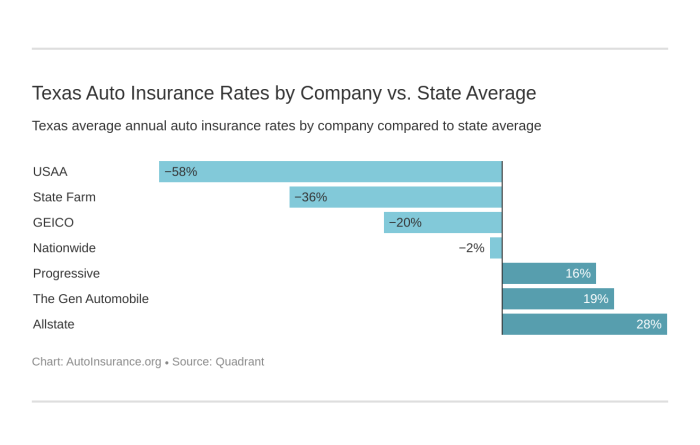

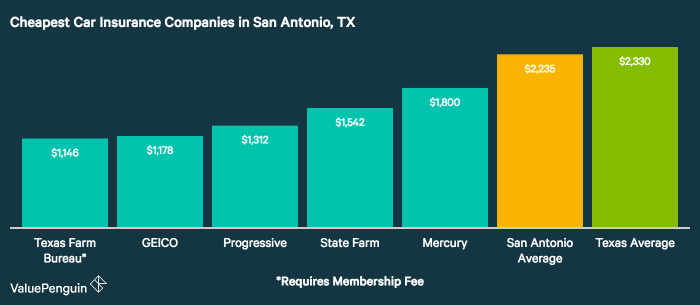

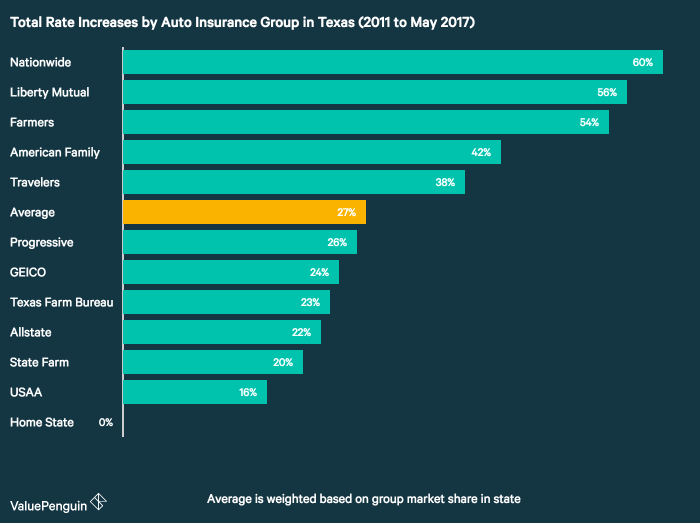

- State Farm: A long-standing and well-respected national provider, State Farm has a substantial presence in Texas. Known for its vast network of agents and extensive coverage options, it’s a popular choice among Texans. Their history emphasizes a commitment to customer service, though pricing can sometimes be higher compared to other providers.

- Progressive: Progressive has a strong online presence and is known for innovative marketing and customer service approaches. They often feature competitive pricing, particularly for younger drivers and those with good driving records. Their efficiency in handling claims is a frequently cited advantage.

- Allstate: A major national player, Allstate provides comprehensive coverage options. Their widespread network and history of customer service make them a familiar choice in Texas. Customer satisfaction varies depending on individual experiences, and pricing strategies can be influenced by market fluctuations.

- Geico: Geico is a large national provider, often associated with lower premiums and a focus on online and digital interactions. They typically have lower pricing for some driver profiles, but their service quality and claim handling processes are variable.

- USAA: A significant provider specializing in military and their families, USAA’s coverage and customer service are highly regarded. However, their customer base is somewhat limited to those affiliated with the military, and they don’t always have competitive rates for non-affiliated individuals.

Financial Strength Ratings

Evaluating the financial strength of an insurance provider is critical. A strong financial rating indicates the provider’s ability to fulfill its obligations and pay claims. These ratings are often compiled by independent organizations.

- Rating Agencies: Insurers are regularly assessed by independent rating agencies like A.M. Best, Moody’s, and Standard & Poor’s. These agencies analyze a company’s financial health and provide ratings that indicate the likelihood of the insurer meeting its financial obligations. High ratings signify a lower risk of insolvency.

- Impact on Consumers: A strong financial rating assures policyholders that their claims will likely be paid promptly and in full. A company with a weak rating might struggle to handle a large number of claims, posing a risk to consumers.

Comparing Strengths and Weaknesses

The table below highlights the strengths and weaknesses of the mentioned providers. These are generalizations and individual experiences may vary.

| Provider | Strengths | Weaknesses |

|---|---|---|

| State Farm | Extensive network, reliable coverage options, strong reputation. | Potentially higher premiums, less emphasis on online interactions. |

| Progressive | Competitive pricing, innovative approaches, strong online presence. | Varied customer service experiences, less extensive network of agents. |

| Allstate | Wide range of coverage options, substantial network, known brand. | Customer satisfaction can fluctuate, pricing may be affected by market trends. |

| Geico | Generally lower premiums, convenient online services. | Potential for inconsistent customer service, variations in claim handling. |

| USAA | Highly regarded service and coverage, excellent for military and affiliated individuals. | Limited customer base, potentially less competitive rates for non-affiliated customers. |

Factors Influencing Consumer Choice

Several factors influence a consumer’s choice of auto insurance provider in Texas. Understanding these factors can help you find the best option.

- Coverage Needs: Specific coverage requirements, like liability, collision, or comprehensive coverage, will influence the selection. The extent of required coverage will determine the optimal provider.

- Premium Costs: Comparing premiums across different providers is essential. Considering your driving record, vehicle type, and location will affect your premium cost.

- Customer Service Reputation: Online reviews and personal accounts provide insight into the service quality of different providers. This aspect is critical for a seamless claims process.

- Financial Strength: Ensuring the provider has a robust financial standing is crucial for claims fulfillment. A company’s financial health will directly affect your coverage security.

Tips for Saving Money on Auto Insurance

Source: cloudinary.com

Finding the right auto insurance in Texas can save you money and ensure your vehicle is protected. Understanding strategies to lower your premiums is crucial for managing your budget. This section provides valuable insights into achieving cost-effective coverage while maintaining adequate protection.

Driving Record Impact on Premiums

A clean driving record is a significant factor influencing auto insurance premiums. Insurance companies assess risk based on driving history. Drivers with fewer accidents and violations generally receive lower premiums. Consistent safe driving practices demonstrably lower your risk profile and reflect positively on your insurance costs.

Discounts and Their Role

Numerous discounts can reduce your auto insurance premiums in Texas. Leveraging these discounts can substantially decrease your monthly payments. Understanding the availability and eligibility for various discounts is crucial to optimizing your coverage.

Available Discounts in Texas, Compare auto insurance quotes in texas

- Multi-policy discount: Bundling your auto insurance with other insurance policies (e.g., homeowners, renters) often results in a reduced premium.

- Good student discount: If you are a student with a good academic record, you may qualify for a discount.

- Safe driver discount: Maintaining a clean driving record, free of accidents and violations, can earn you a safe driver discount.

- Defensive driving course completion: Completing a defensive driving course demonstrates your commitment to safe driving practices and can result in a reduced premium.

- Payment method discount: Some insurance providers offer discounts for paying your premiums on time and in full.

- Vehicle safety features discount: If your vehicle has advanced safety features, like anti-theft systems or airbags, this could qualify you for a discount.

- Telematics discount: Some insurance companies use telematics devices to monitor your driving habits and offer discounts for safe driving.

Maintaining a Safe Driving Record

Maintaining a safe driving record is paramount for lowering insurance premiums. A clean driving record demonstrates your commitment to safe driving practices and is highly valued by insurance companies. Accidents and violations increase your risk profile, which consequently leads to higher insurance premiums. Proactive steps, like adhering to speed limits, avoiding distracted driving, and driving defensively, can positively influence your driving record.

| Discount Type | Description |

|---|---|

| Multi-Policy | Combining multiple insurance policies (auto, homeowners, etc.) |

| Good Student | Enrolled in school with a good academic record |

| Safe Driver | Maintaining a clean driving record |

| Defensive Driving | Completion of a defensive driving course |

| Payment Method | Paying premiums on time and in full |

| Vehicle Safety Features | Vehicle equipped with advanced safety features |

| Telematics | Using a telematics device to monitor driving habits |

Choosing the Right Policy

Source: cloudinary.com

Selecting the right auto insurance policy in Texas is crucial for financial protection and peace of mind. Understanding your specific needs and comparing various policy types is essential to securing the most suitable coverage at a competitive price. This involves careful consideration of your driving history, vehicle type, and desired coverage levels.Choosing the right auto insurance policy involves a structured approach that considers several factors.

A thorough evaluation of your individual circumstances, along with a comparison of policy features, is vital. This process ultimately aims to provide adequate coverage without unnecessary expense.

Policy Type Comparisons

Different policy types cater to diverse needs and risk profiles. Understanding the advantages and disadvantages of each type is vital in selecting the most appropriate one.

- Liability Coverage: This basic policy covers damages you cause to others in an accident. While providing the most basic protection, it offers minimal coverage for your own vehicle or medical expenses. It’s often the least expensive option but lacks comprehensive protection.

- Collision Coverage: This policy covers damages to your vehicle regardless of who is at fault in an accident. It’s useful for ensuring your vehicle is repaired or replaced if damaged in an accident, even if you are responsible. The cost of this coverage is usually higher than liability coverage.

- Comprehensive Coverage: This policy covers damage to your vehicle from incidents other than collisions, such as vandalism, theft, or weather events. It provides additional protection beyond collision coverage, offering a more complete safeguard against unforeseen events. The cost of this coverage is typically higher than liability and collision coverage, but offers more comprehensive protection.

- Uninsured/Underinsured Motorist Coverage: This coverage is critical if you’re involved in an accident with a driver lacking sufficient insurance. It steps in to cover damages if the at-fault driver doesn’t have enough coverage or is uninsured, protecting your financial interests. This is essential for comprehensive protection.

Reading and Understanding the Policy Document

Carefully reviewing the policy document is paramount. Understanding the terms and conditions is essential for avoiding future surprises and ensuring that the policy meets your needs. It’s advisable to seek professional assistance if you have difficulty interpreting complex legal jargon.

- Policy Exclusions: A key aspect is recognizing exclusions, which are specific situations or circumstances not covered by the policy. These exclusions can vary between insurers and policy types.

- Coverage Limits: Understanding the maximum amount the policy will pay out for various types of claims is crucial. Knowing these limits is important for planning and avoiding financial surprises.

- Deductibles: The deductible is the amount you pay out-of-pocket before the insurance company begins to pay for repairs or damages. Lowering this deductible often results in higher monthly premiums. The deductible amount is an important factor to consider when choosing a policy.

Comparing Policies Based on Specific Needs

Tailoring your insurance policy to your unique needs is key. Considering factors like vehicle value, driving history, and location is essential in securing the best coverage. Consider your specific needs and how the various options will apply to your circumstances.

| Factor | Explanation | Impact on Policy Selection |

|---|---|---|

| Vehicle Value | The value of your vehicle influences the amount of coverage needed in case of total loss. | Higher vehicle value might require higher collision and comprehensive coverage. |

| Driving History | A clean driving record often leads to lower premiums. | Safe drivers qualify for lower premiums, reflecting their lower risk profile. |

| Location | Traffic density and accident rates in your area influence premium costs. | Areas with higher accident rates will usually have higher insurance premiums. |

Policy Selection Process

A structured approach to policy selection involves several steps.

- Assess your needs: Determine the type and level of coverage required based on your driving habits, vehicle value, and financial situation. This assessment should include a careful evaluation of potential risks.

- Compare quotes: Obtain quotes from multiple insurance providers to identify competitive pricing and coverage options. Comparing quotes across various providers is essential.

- Review policy documents: Carefully read and understand each policy document to ensure it aligns with your requirements. Thorough policy review is vital to avoid misunderstandings.

- Choose the best policy: Select the policy that offers the most comprehensive coverage at the most competitive price, considering your specific needs and circumstances. Making the right choice ensures peace of mind.

Additional Resources

Navigating the complexities of auto insurance in Texas can be simplified with the right resources. This section provides access to government agencies, consumer protection organizations, and reliable comparison tools to aid in your search for the best policy. Thorough research empowers informed decisions and helps you avoid potential pitfalls.

Government Agencies and Consumer Protection Organizations

Texas residents have access to several valuable resources to ensure fair and transparent insurance practices. Understanding your rights and options is crucial when interacting with insurance providers. These resources offer support and guidance in case of disputes or concerns.

- Texas Department of Insurance (TDI): The TDI is a crucial resource for Texans seeking information about insurance regulations, licensing, and consumer complaints. They provide a platform for filing complaints and reporting potential violations. Their website offers a wealth of information about insurance products, including auto insurance.

- Texas Attorney General’s Office: The Attorney General’s office acts as a consumer advocate, providing support and assistance with consumer protection issues, including insurance. They may offer resources for resolving disputes or investigating fraudulent practices.

- Federal Trade Commission (FTC): While not specific to Texas, the FTC provides valuable resources for consumers nationwide, including information on consumer rights, identity theft protection, and resolving disputes with businesses. This is a helpful federal-level resource for broader consumer protection issues.

Reliable Resources for Comparing Auto Insurance Quotes in Texas

Finding accurate and reliable resources to compare auto insurance quotes is key to securing a competitive rate. Using trustworthy comparison tools saves time and effort while ensuring a comprehensive overview of options.

- Insurify: Insurify provides a streamlined platform to compare quotes from multiple insurers. Users can input their vehicle details, driving history, and desired coverage options to receive tailored quotes from various providers. This is an example of a reputable online comparison tool.

- Policygenius: Policygenius is another online comparison tool that assists users in comparing auto insurance quotes from various companies. This tool offers an easy-to-use interface for exploring coverage options and receiving personalized quotes. It is known for its wide range of coverage options.

- Insure.com: Insure.com is a well-established comparison website that helps users in finding competitive auto insurance rates. The platform allows users to compare quotes from different insurance companies based on their specific needs and requirements.

Resources for Additional Insights

Understanding the nuances of Texas auto insurance requires exploring various resources. This includes reading articles, attending seminars, or consulting with insurance professionals.

- Insurance Industry Publications: Industry publications often provide detailed analyses of insurance trends, coverage options, and regulatory updates. These publications can be valuable resources for staying informed.

- Financial Advisors: Financial advisors may provide insights into insurance strategies, including auto insurance. Their expertise can help you choose a policy that aligns with your overall financial plan.

- Consumer Reports: Consumer Reports provides independent analyses and ratings of insurance companies and products. This resource can offer valuable insights into the reliability and financial stability of insurance providers.

Organizations Assisting with Policy Comparison

Several organizations can assist with the complex process of comparing auto insurance policies. Their services and resources can help you navigate the insurance market effectively.

| Organization | Assistance Provided |

|---|---|

| Independent Insurance Agents | Offer personalized advice, compare quotes from multiple companies, and help understand complex policy terms. |

| Insurance Brokers | Specialize in comparing insurance products from different providers, helping you find the best coverage at the best price. |

| Online Comparison Tools | Provide a platform to compare quotes from various insurers, simplifying the process of finding the right coverage. |

Last Word

In conclusion, comparing auto insurance quotes in Texas is a crucial step in securing affordable and adequate coverage. By understanding the factors that influence premiums, comparing quotes from multiple providers, and considering your specific needs, you can make informed decisions and save money. Remember to thoroughly review policy details, understand coverage options, and consider discounts available. This comprehensive guide will empower you to find the perfect auto insurance policy for your situation.

Helpful Answers

What are the minimum insurance requirements in Texas?

Texas mandates specific minimum coverage levels for liability insurance. These vary slightly depending on the type of coverage. It’s vital to ensure your policy meets or exceeds these minimums to avoid penalties.

How can I compare auto insurance quotes online?

Many online tools and websites specialize in comparing quotes from various Texas insurance providers. Simply input your information, and the site will provide tailored quotes. Comparing quotes from multiple providers is essential for identifying the best rates.

What are some common discounts offered for auto insurance in Texas?

Several discounts are available, such as multi-policy discounts, good student discounts, and safe driver discounts. Investigating these options can lead to significant savings on your premiums.

How does my driving record affect my insurance premiums in Texas?

A clean driving record generally results in lower insurance premiums. Traffic violations and accidents can negatively impact your rates. Maintaining a safe driving record is vital for long-term cost savings.