Compare Texas auto insurance rates to find the best deal for your needs. Texas insurance rates vary widely depending on factors like your driving record, vehicle type, and location. This guide provides a comprehensive overview of how to compare Texas auto insurance rates effectively and find lower premiums.

Understanding the factors influencing Texas auto insurance rates is crucial. This guide delves into the intricacies of coverage types, discounts, and provider comparisons to empower you to make informed decisions. It also Artikels strategies for finding lower rates and analyzing coverage options.

Understanding Texas Auto Insurance

Source: cloudinary.com

Navigating the world of auto insurance can feel overwhelming, especially in a state like Texas with its diverse driving conditions and regulations. Understanding the factors that influence your rates and the various coverage options available is crucial for making informed decisions and securing the right protection. This guide provides a comprehensive overview of Texas auto insurance, covering key aspects from coverage types to discounts.

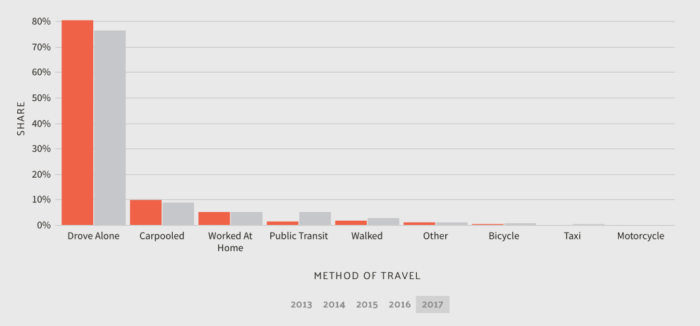

Factors Influencing Auto Insurance Rates in Texas

Texas auto insurance rates are influenced by a multitude of factors, reflecting the risks associated with different drivers, vehicles, and locations. These factors work together to determine the premium you pay. Premiums are not static; they adjust based on the assessed risk.

- Driving Record: A clean driving record, free from accidents and traffic violations, generally leads to lower premiums. A history of speeding tickets, DUIs, or accidents significantly increases rates. For example, a driver with multiple speeding tickets might see a 50% or more increase in their premium compared to a driver with a clean record.

- Vehicle Type and Age: Certain vehicles are considered higher-risk due to their potential for damage or theft. Older vehicles, especially those without modern safety features, tend to have higher premiums. Luxury sports cars and high-performance vehicles often command higher premiums compared to standard models. A classic car, for instance, might have a significantly higher premium than a newer, comparable car due to its higher risk of damage or theft.

- Location: Insurance companies assess the risk based on the area you live in. High-accident areas and high-theft zones tend to have higher premiums. Areas with higher population density or a greater concentration of young drivers might see higher rates as well.

- Age and Gender: Insurance companies often consider the age and gender of the driver. Younger drivers are often perceived as higher-risk and pay higher premiums, sometimes because they lack experience or have a tendency to engage in risky behaviors behind the wheel. This can vary based on the driver’s history, and specific insurance companies have different ways of assessing these factors.

- Coverage Choices: The type and amount of coverage selected directly impact the premium. Choosing comprehensive and collision coverage, which protects against damage or accidents, will increase your premium compared to selecting only liability coverage, which only covers damages to others.

Common Types of Auto Insurance Coverage in Texas

Texas requires a minimum level of liability coverage, but you can opt for additional coverage to protect yourself.

| Coverage Type | Description |

|---|---|

| Liability | Covers damages you cause to others’ property or injuries to others in an accident. |

| Collision | Covers damage to your vehicle in an accident, regardless of who is at fault. |

| Comprehensive | Covers damage to your vehicle from events other than accidents, such as vandalism, theft, or weather-related incidents. |

| Uninsured/Underinsured Motorist | Protects you if you’re in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers in an accident, regardless of who is at fault. |

Driving Record Impact on Insurance Premiums

A driver’s history significantly impacts insurance premiums. Accidents, violations, and claims all contribute to the risk assessment, ultimately affecting the premium. A driver with a clean record demonstrates a lower risk, resulting in lower premiums. Conversely, a driver with a history of violations or accidents faces higher premiums.

Vehicle Type and Age Influence on Rates

The type and age of your vehicle are factors in determining your insurance premium. Higher-value vehicles or those prone to theft might command higher premiums. Similarly, older vehicles often require more frequent repairs, increasing the potential cost of repairs and claims, and thus, the insurance premium.

Factors Influencing Rates – Categorized

Understanding the factors impacting your Texas auto insurance rates is key to managing your costs.

- Driver Factors: Driving record, age, gender, location, and driving habits.

- Vehicle Factors: Vehicle type, age, make, model, and safety features.

- Coverage Factors: Chosen coverage types (liability, collision, comprehensive, etc.) and the amount of coverage.

- Location Factors: Specific location, accident rates, and theft rates.

Discounts Available in Texas

Several discounts are available to help reduce your Texas auto insurance premium.

- Defensive Driving Courses: Completing a defensive driving course can often qualify you for a discount.

- Multiple-Vehicle Discounts: Insuring multiple vehicles with the same company can often lead to a discount.

- Good Student Discounts: Students with good grades may qualify for discounts.

- Safe Driver Discounts: Drivers with a clean driving record may qualify for discounts.

- Bundled Discounts: Combining auto insurance with other insurance products, such as homeowners insurance, can often result in discounts.

Comparing Insurance Providers

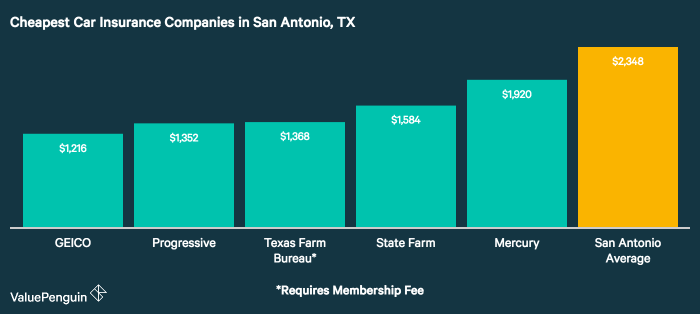

Shopping for auto insurance in Texas involves evaluating various providers and their pricing strategies. Understanding these differences empowers you to make informed decisions and potentially save money. Careful comparison of quotes and features is key to securing the best coverage for your needs and budget.

Pricing Strategies of Texas Auto Insurance Providers

Texas insurance companies employ diverse pricing strategies, often based on factors like driving history, vehicle type, location, and age. Some companies might offer discounts for safe driving records or for bundling policies (combining auto, home, and other insurance). Others may use a more competitive, market-based approach. Analyzing these variations is crucial to finding a suitable policy at a competitive price.

Reputable Texas Insurance Companies

Several reputable insurance companies operate in Texas. Choosing a company with a strong financial rating and a history of good customer service is important. Researching their claims handling procedures and customer reviews can help assess their reliability. Examples of well-regarded companies include State Farm, Allstate, Geico, Progressive, and Liberty Mutual.

Examples of Insurance Provider Websites

Many Texas insurance companies have user-friendly websites. These websites typically offer online quote tools, allowing you to compare coverage options. Exploring the websites of the aforementioned companies will show examples of such online quote systems. State Farm, for example, allows users to quickly input their details for an immediate quote. Allstate also provides online quote tools and resources.

Obtaining Quotes from Multiple Providers

Obtaining quotes from several providers is essential for comparing prices. This ensures a comprehensive overview of the market rates. The process usually involves completing online forms or contacting companies directly. Gathering a range of quotes is an effective first step in evaluating your options.

Comparing Quotes Effectively

Comparing quotes effectively involves carefully reviewing coverage details, deductibles, and premium amounts. It’s crucial to understand what is included and excluded from the coverage, as different companies may offer varying options. Comparing features and costs side-by-side is a critical step in identifying the best fit for your needs. Pay close attention to the fine print.

Comparison of Major Texas Insurance Providers

| Insurance Provider | Average Premium (Estimated) | Key Features | Discounts Offered |

|---|---|---|---|

| State Farm | $1,500-$2,000 per year | Strong customer service reputation, extensive network of agents, and various coverage options. | Safe driver discounts, multi-policy discounts, and student discounts. |

| Allstate | $1,400-$1,900 per year | Wide range of coverage choices, competitive rates, and online tools for managing accounts. | Defensive driving discounts, anti-theft device discounts, and multi-policy discounts. |

| Geico | $1,200-$1,700 per year | Generally lower premiums compared to other major providers, user-friendly online platform. | Good student discounts, multi-policy discounts, and safe driver discounts. |

Note: Premiums are estimates and may vary based on individual circumstances.

Reading Policy Documents Carefully

Thoroughly reviewing policy documents is crucial. Policy documents detail the terms, conditions, and exclusions of the coverage. Understanding these aspects is essential for making a well-informed decision. Failing to scrutinize the policy can lead to unforeseen issues down the road. Comprehending the specifics ensures that you have the right coverage.

Strategies for Finding Lower Rates

Source: autoinsuranceez.com

Securing the best Texas auto insurance rates involves a multifaceted approach. Understanding the various methods for comparison, the availability of discounts, and the importance of coverage levels are all crucial elements in achieving cost-effective protection. This section Artikels effective strategies for finding lower premiums, helping you make informed decisions to minimize your insurance expenses.

Comparison Methods

Comparing rates is essential for finding the most competitive pricing. Several methods facilitate this process, each with unique benefits. Directly visiting multiple insurance provider websites is a straightforward method. Online comparison tools are another option, providing a streamlined overview of various quotes. Speaking with insurance agents allows for personalized guidance and detailed explanations of different plans.

Discount Strategies

Many discounts can significantly reduce your premium. These often come in the form of rewards for safe driving habits, vehicle features, or specific lifestyle factors. Understanding these discounts can substantially impact your overall cost.

Safe Driver Discounts

Safe driving habits are often rewarded with substantial discounts. Companies typically recognize and incentivize drivers with clean driving records, exemplified by a lack of accidents or traffic violations. Insurance providers might also reward drivers who have completed defensive driving courses or have installed advanced safety features in their vehicles, like airbags or anti-theft systems. For example, a driver with a spotless driving record for five years might receive a 15% discount on their premium.

Another example includes a discount for installing a car alarm system or a dashcam.

Finding Deals and Promotions

Staying informed about deals and promotions is key to finding lower rates. Insurance companies frequently announce discounts and offers. Monitoring their websites or contacting an agent can help you keep abreast of these opportunities. Examples of such deals might include a special rate for new customers or a promotion during a specific time of year.

Avoiding Common Mistakes, Compare texas auto insurance rates

Comparing rates involves careful consideration. One common mistake is overlooking the details of different coverage levels. Another pitfall is not thoroughly comparing multiple quotes from various providers. A crucial point to remember is that a lower premium does not always mean a lower level of protection. It is critical to understand the terms and conditions of any policy to avoid future complications.

Coverage Level Comparison

Carefully comparing different coverage levels is critical. Comprehensive coverage, collision coverage, and liability coverage all affect the final premium. Comparing the specifics of these coverage levels is crucial to selecting the best plan for your individual needs. For instance, choosing a lower deductible can potentially reduce your premium, but it also means you will pay more out-of-pocket in the event of an accident.

Online Comparison Tools

Online comparison tools can simplify the process of finding the most competitive rates. These tools gather quotes from various insurers, enabling quick comparisons. They provide a clear view of the different options, allowing for easy selection. Many comparison sites provide a variety of filtering options, enabling users to tailor their searches to their specific needs. The use of online comparison tools typically results in a significant time saving.

Step-by-Step Guide to Obtaining the Best Rates

- Assess your current policy, noting coverage levels, premiums, and discounts.

- Use online comparison tools to gather quotes from multiple insurers.

- Compare the quotes, considering not only the premium but also the coverage levels and associated costs.

- Contact insurers directly to inquire about any discounts or promotions that may apply.

- Evaluate the details of each policy, focusing on the fine print and specific terms.

- Review coverage levels, ensuring adequate protection for your needs and budget.

- Select the policy that offers the best combination of coverage, cost, and discounts.

Analyzing Coverage Options

Understanding the various coverage options available for your Texas auto insurance is crucial for securing adequate protection while minimizing costs. Different coverages address different risks, and the optimal choice depends on your individual driving habits, financial situation, and the specific vehicles you insure. A thorough understanding of these options empowers you to make informed decisions that align with your needs and budget.Texas auto insurance mandates certain coverages, but beyond those minimums, you can customize your policy to match your personal risk tolerance and financial circumstances.

This allows for tailoring your coverage to fit your specific situation.

Types of Coverage Offered

Texas auto insurance policies typically include liability, collision, and comprehensive coverage. Understanding the nuances of each type is essential for making the right choice. Liability coverage protects you from financial responsibility if you cause an accident and injure someone or damage their property. Collision coverage protects your vehicle if it’s damaged in an accident, regardless of who is at fault.

Comprehensive coverage, on the other hand, safeguards your vehicle from damage caused by events other than collisions, such as theft, vandalism, or weather-related incidents.

Comparing Coverage Costs

The cost of each coverage option varies significantly based on factors like your driving record, vehicle type, and the specific insurer. Premiums for liability coverage tend to be lower than those for collision or comprehensive coverage, reflecting the differing levels of risk involved. Shopping around for quotes from multiple insurers is crucial for identifying the best rates for the level of protection you need.

Insurers often offer discounts for safe driving practices, such as maintaining a clean driving record or installing anti-theft devices.

Benefits and Drawbacks of Each Option

Liability coverage provides fundamental protection against financial responsibility for accidents you cause. The primary benefit is financial protection. However, a significant drawback is that it only covers damages to other parties. Collision coverage protects your vehicle regardless of fault, but it comes with a higher premium. The benefit is the protection of your investment in the vehicle.

The drawback is the cost of the coverage. Comprehensive coverage provides an added layer of protection against a broader range of damages, offering peace of mind from theft or weather-related damage. The drawback is that comprehensive coverage comes with the highest premiums.

Importance of Choosing Appropriate Coverage

Choosing the right coverage is paramount for ensuring financial protection and peace of mind. Insufficient coverage can leave you exposed to significant financial burdens in the event of an accident or other unforeseen damages. Conversely, excessive coverage can lead to unnecessary expenses. Careful consideration of your individual circumstances and risk tolerance is crucial for selecting the optimal coverage combination.

Comparison Table

| Coverage Type | Description | Typical Cost | Benefits | Drawbacks |

|---|---|---|---|---|

| Liability | Covers damages to others in an accident you cause. | Lowest | Fundamental protection against financial responsibility. | Only covers damages to others, not your vehicle. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Mid-range | Protects your vehicle investment. | Higher premium compared to liability. |

| Comprehensive | Covers damage to your vehicle from events other than collisions (theft, vandalism, weather). | Highest | Added layer of protection against various damages. | Highest premium among the three. |

Coverage Scenarios and Costs

A driver with a clean record and a newer vehicle might find liability coverage sufficient and affordable. Conversely, a driver with a history of accidents might require a higher level of coverage, including collision and comprehensive coverage, at a greater cost. Insurance premiums can vary significantly based on these factors.

Impact of Deductibles on Insurance Premiums

Higher deductibles generally lead to lower insurance premiums.

A higher deductible means you’ll pay a larger amount out-of-pocket in the event of a claim before your insurance kicks in. This directly affects your premium costs. Lower deductibles mean a higher premium.

Factors to Consider When Choosing Coverage

- Driving record: A clean driving record often leads to lower premiums.

- Vehicle type: Newer, more expensive vehicles typically have higher insurance premiums.

- Coverage needs: Evaluate your risk tolerance and potential financial liabilities.

- Financial situation: Consider your ability to absorb potential out-of-pocket costs.

- Discounts: Explore available discounts, such as safe driver discounts or anti-theft device discounts.

- Comparison shopping: Obtain quotes from multiple insurers to identify the best rates.

Additional Considerations: Compare Texas Auto Insurance Rates

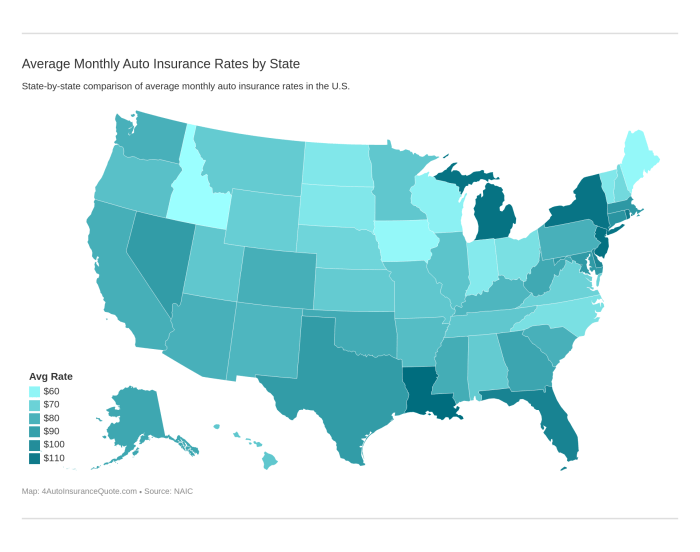

Source: 4autoinsurancequote.com

Beyond the basic factors influencing auto insurance rates in Texas, several other crucial elements play a significant role. Understanding these nuances can help you make informed decisions and potentially secure more favorable insurance premiums. Factors like your credit score, claims history, location, and agent choices can all impact your final rate.

Credit Scores and Insurance Rates

Credit scores are increasingly being used by insurance companies to assess risk. A lower credit score often translates to a higher insurance premium. This is because a poor credit history can suggest a higher likelihood of risky behavior, such as making late payments or incurring financial difficulties, which can potentially correlate with increased accident risk. For example, a driver with a poor credit history might be considered a higher-risk driver by the insurer, resulting in higher premiums.

Claims History and Future Rates

Your past claims history significantly impacts future insurance rates. Insurers analyze claims data to assess risk. A history of accidents or claims will likely result in higher premiums for future coverage. The severity of past claims also influences future rates. A major accident, for example, will likely lead to a more substantial increase in premiums than a minor fender bender.

This is because insurers aim to balance the risk they take on by pricing their policies accordingly.

Location within Texas and its Impact

Texas’s diverse geography significantly affects insurance rates. Certain areas within the state have a higher concentration of traffic, accidents, or specific weather patterns. Insurance companies account for these local variations when setting rates. High-accident areas, for example, will generally have higher premiums due to the increased risk for the insurance company.

Examples of Location Impact on Premiums

In urban areas with high traffic volumes and higher accident rates, like major metropolitan areas, insurance premiums tend to be higher. On the other hand, rural areas with fewer accidents and lower traffic density typically see lower premiums. A comparison of premiums in a major city like Houston and a smaller, less congested town might reveal a substantial difference in the cost of coverage.

Different Insurance Agents in Texas

Texas has a wide array of insurance agents. Working with a reputable agent can prove beneficial. Agents often have expertise in finding suitable coverage plans that best suit your needs and budget. Agents can also provide valuable insights into coverage options and potential savings. Some agents specialize in particular types of coverage, so finding the right one is crucial.

Understanding Policy Terms

Thoroughly understanding your insurance policy terms is vital. It is crucial to review policy details, understand coverage limits, and know what is and is not covered. Carefully review exclusions, deductibles, and coverage amounts. Reviewing the fine print can help avoid surprises or misunderstandings down the line.

Factors Influencing Insurance Rates

| Factor | Impact on Rates |

|---|---|

| Credit Score | Lower scores typically result in higher premiums. |

| Claims History | Accidents and claims increase future premiums. |

| Location | High-accident areas lead to higher premiums. |

| Driving Record | Traffic violations and accidents increase premiums. |

| Vehicle Type | High-performance or luxury vehicles may have higher premiums. |

| Coverage Options | Higher coverage levels increase premiums. |

Filing a Claim in Texas

Filing a claim in Texas involves specific procedures. It is important to contact your insurance company as soon as possible after an accident. Gather all necessary documentation, including police reports, medical records, and witness statements. Cooperate fully with the insurance adjuster to expedite the claims process. A thorough and prompt claim filing process can help in a smooth resolution.

Final Review

Source: cloudinary.com

In conclusion, comparing Texas auto insurance rates is a vital step toward securing affordable and adequate coverage. By understanding the key factors, comparing providers, and analyzing coverage options, you can make informed choices to protect yourself and your vehicle. Remember to carefully review policy documents and consider all available discounts to get the best possible rate.

FAQ Insights

What are the most common types of auto insurance coverage in Texas?

Common coverages include liability, collision, and comprehensive. Liability covers damages you cause to others, while collision and comprehensive cover damages to your vehicle, regardless of who is at fault.

How does my credit score affect my Texas auto insurance rates?

Credit scores are sometimes a factor in determining insurance rates. A lower credit score may result in a higher premium.

What are some common discounts available for Texas auto insurance?

Discounts vary by provider, but some common ones include discounts for safe drivers, multiple vehicles, and anti-theft devices.

How can I compare quotes from multiple insurance providers effectively?

Use online comparison tools or contact multiple providers directly to get quotes. Compare the total cost of coverage, including premiums and deductibles.